Abstract

This paper investigates the efficacy of a trading strategy that leverages the Volatility Risk Premium (VRP) to inform trading decisions for exchange-traded funds (ETFs) such as SVXY, VIXY, SPY, and QQQ. The VRP serves as a predictor for market volatility. The core hypothesis posits that the VRP is often overestimated by the market, leading to profitable contrarian trading opportunities. By systematically buying SVXY, VIXY, SPY, and QQQ based on specific conditions related to whether the VRP is positive or negative, the strategy aims to exploit mean reversion in volatility, thereby generating superior risk-adjusted returns. This paper outlines the theoretical foundation, empirical methodology, and performance evaluation of the proposed strategy. The results indicate that leveraging an overestimated VRP can significantly enhance portfolio performance and provide robust volatility management. Future research directions could include exploring the strategy's applicability in different market environments and refining VRP predictions with machine learning techniques.

Introduction

The study investigates a trading strategy that leverages the Volatility Risk Premium (VRP) to generate significant returns. This strategy focuses on exploiting an overestimated VRP by employing a contrarian approach to trading exchange-traded funds (ETFs). The paper outlines the theoretical underpinnings of VRP, the implementation of the trading strategy, and an empirical analysis of its performance over a historical period.

Financial markets are inherently volatile, with periods of calm often interspersed with episodes of significant turbulence. Investors' expectations of future market volatility are captured by the Volatility Risk Premium (VRP), which is the difference between implied volatility and realized volatility. The VRP is a crucial metric as it reflects market sentiment and perceived risk.

Traditional investment strategies often assume that implied volatility accurately reflects future market conditions. However, behavioral finance theories suggest that markets can overreact, leading to inflated implied volatility. Studies by Bollerslev et al. (2009) and Carr & Wu (2009) indicate that the market's expectations often exceed actual volatility, creating opportunities for contrarian strategies.

ETFs Utilized in the Strategy:

- SVXY: ProShares Short VIX Short-Term Futures ETF, which benefits from declining volatility.

- VIXY: ProShares VIX Short-Term Futures ETF, which tracks short-term VIX futures.

- SPY: SPDR S&P 500 ETF Trust, which seeks to track the performance of the S&P 500 Index.

- QQQ: Invesco QQQ Trust, which tracks the performance of the NASDAQ-100 Index.

These ETFs were chosen due to their diverse exposure to market volatility and their potential to hedge against different volatility scenarios. By capitalizing on the overestimation of VRP, the strategy aims to exploit mean reversion in volatility, thereby generating superior risk-adjusted returns.

The primary objective of this study is to assess whether this trading strategy can yield significant returns. This involves a detailed examination of the theoretical foundation of VRP, the practical implementation of the trading strategy, and an empirical evaluation of its performance over historical data. This paper aims to contribute to the existing literature on volatility trading and provide practical insights for investors seeking to optimize their ETF portfolios through informed volatility-based decisions.

Theoretical Foundation of the Volatility Risk Premium (VRP)

The Volatility Risk Premium (VRP) is a critical concept in understanding market behavior and forming the basis of various trading strategies. The VRP is defined as the difference between implied volatility, and realized volatility, which is the actual observed volatility of the underlying asset over a specific period. This section delves into the theoretical underpinnings of the VRP, its significance, and its application in trading strategies.

- Implied Volatility and Realized Volatility:

- Implied Volatility: Implied volatility reflects the market's forecast of a security's future volatility. It represents the market's consensus view on the magnitude of future price movements and is a forward-looking measure.

- Realized Volatility: Realized volatility, on the other hand, is the actual volatility observed in the price movements of a security over a historical period. It is calculated using the standard deviation of the asset's returns over the specified time frame.

- Understanding the VRP: The VRP arises due to the difference between the market's expectation of future volatility (implied volatility) and the actual observed volatility (realized volatility). This premium is influenced by several factors, including investor sentiment, market uncertainty, and risk aversion. Theoretically, the VRP compensates investors for taking on the risk associated with holding volatile assets.

- Behavioral Finance Perspective: Behavioral finance provides a framework for understanding why the VRP might be overestimated. According to behavioral finance theories, market participants often exhibit irrational behavior, such as overreacting to new information or being influenced by emotions like fear and greed. This can lead to inflated implied volatility as investors overestimate the potential for future market turbulence.

- Empirical Evidence: Empirical studies, such as those by Bollerslev et al. (2009) and Carr & Wu (2009), have shown that the market's expectations often exceed actual volatility, resulting in a positive VRP. These studies suggest that investors demand a higher premium for perceived volatility risk, which can be exploited through contrarian trading strategies.

- Applications in Trading Strategies: The VRP can be utilized in various trading strategies to achieve superior risk-adjusted returns. For instance:

- Contrarian Strategies: By exploiting the overestimation of implied volatility, traders can adopt a contrarian approach, buying when the VRP is high and selling when it is low.

- Volatility Arbitrage: Traders can engage in volatility arbitrage by simultaneously buying and selling options to capitalize on the difference between implied and realized volatility.

- ETF Trading: As discussed in this study, ETFs such as SVXY, VIXY, SPY, and QQQ can be used to implement VRP-based strategies, allowing traders to benefit from mean reversion in volatility.

Risk Management: Understanding and accurately estimating the VRP is crucial for effective risk management. By recognizing periods of overestimated VRP, investors can adjust their portfolios to mitigate potential losses and enhance returns. Proper risk management techniques, such as position sizing and stop-loss orders, are essential when implementing VRP-based strategies.

Conclusion: The VRP is a fundamental concept that reflects the market's perception of risk and uncertainty. By examining the difference between implied and realized volatility, traders can identify opportunities for profit through well-informed trading strategies. The theoretical foundation of the VRP, supported by empirical evidence, underscores its importance in financial markets and its potential for generating significant returns.

Trading Rules for the VRP-Based Strategy

The strategy leverages the Volatility Risk Premium (VRP) to inform decisions for trading various exchange-traded funds (ETFs) including SVXY, VIXY, SPY, and QQQ. Here are the detailed trading rules:

Calculate Volatility Risk Premium (VRP)

- VRP Calculation:

- VRP is calculated as the difference between the implied volatility and the realized volatility.

- Determine Entry and Exit Conditions:

- Positive VRP: When VRP is greater than zero, indicating that the market expects future volatility to be higher than historical volatility. Traditionally, this implies that investors are expecting increased uncertainty or risk in the market, which often correlates with potential declines in stock prices as investors seek to hedge against anticipated volatility. When VRP is positive, it generally suggests that the VIX (a measure of expected market volatility) is expected to go up. However, the strategy assumes that this expectation is overestimated, and that actual volatility will be lower than anticipated, leading to a contrarian position.

Position Sizing and Trade Executions

- SVXY (Short VIX Short-Term Futures ETF):

- Buy: When VRP is positive, based on the assumption that the market is overestimating future volatility and that the VIX will decrease.

- Sell: When VRP is negative.

- Position Size: Typically set to 10% of equity.

- Stop Loss: Apply a stop-loss of 25%

- Rationale for SVXY: SVXY is chosen because it benefits when the VIX declines. Given the strategy's premise that the market often overestimates volatility, SVXY stands to profit as volatility reverts to lower levels.

- VIXY (ProShares VIX Short-Term Futures ETF):

- Buy: When VRP is negative and additional conditions are met, such as lower daily volatility and a VIX level below a specified maximum.

- Sell: When VRP is positive or when other conditions indicate an exit, such as higher daily volatility or certain momentum indicators.

- Position Size: Set to 60% of the size allocated for VXX.

- Conditions:

- Buy when VRP is negative, daily volatility is low, the VIX is below the maximum level, and recent price trends are favorable.

- Sell when VRP is positive, daily volatility is high, momentum indicators are unfavorable, or the VIX is below its moving average.

- Rationale for SVXY: SVXY is chosen because it benefits when the VIX declines. Given the strategy's premise that the market often overestimates volatility, SVXY stands to profit as volatility reverts to lower levels.

- SPY (S&P 500 ETF) and QQQ (NASDAQ-100 ETF):

- Buy: When VRP is positive and momentum indicators are positive.

- Sell: When VRP is negative or momentum indicators turn negative.

- Position Size: Adjusted dynamically based on (*)Mansfield Relative Performance (MRP) indicator and on additional conditions indicating market strength or weakness.

(* ) Mansfield Relative Performance (MRP): The MRP measures the relative strength of one security against another, often used to compare an individual stock to a benchmark index. A positive MRP indicates that the security is outperforming the benchmark, while a negative MRP indicates underperformance. - Rationale for SPY and QQQ: SPY and QQQ provide broad exposure to major market indices. Their inclusion in the strategy allows for capturing market movements and optimizing returns when market conditions are favorable. The MRP helps in dynamically adjusting positions to maximize gains and minimize risks based on market performance relative to the benchmark.

Summary of the Strategy

The strategy systematically buys SVXY, VIXY, SPY, and QQQ based on the Volatility Risk Premium (VRP) and additional conditions. The core hypothesis is that the VRP is often overestimated by the market, leading to profitable contrarian trading opportunities. By assuming that a positive VRP indicates an overestimation of future volatility, the strategy positions itself to benefit from mean reversion.

The strategy’s approach involves:

- Buying SVXY: When VRP is positive, based on the expectation that the VIX will decrease.

- Buying VIXY: When VRP is negative, anticipating rising volatility.

- Trading SPY and QQQ: Using momentum indicators and the Mansfield Relative Performance (MRP) to dynamically adjust positions, capturing market movements and optimizing returns.

By combining these indicators and managing risk through position sizing and stop-loss orders, the strategy aims to capture market inefficiencies and generate superior risk-adjusted returns. The chosen ETFs complement each other by providing diverse exposure to market volatility, allowing the strategy to hedge against different volatility scenarios. This comprehensive approach reinforces the hypothesis that exploiting an overestimated VRP can significantly enhance portfolio performance and provide robust volatility management.

Backtesting Results, Returns and Metrics

In this section, we meticulously dissect the performance of the VRP-based trading strategy through rigorous backtesting. This analysis is pivotal in translating theoretical constructs into empirical evidence, providing a clear picture of how the strategy fares in the practical realm of financial markets.

We aim to furnish a comprehensive understanding of the strategy's historical performance, offering valuable insights into its potential applicability and effectiveness in varying market conditions.

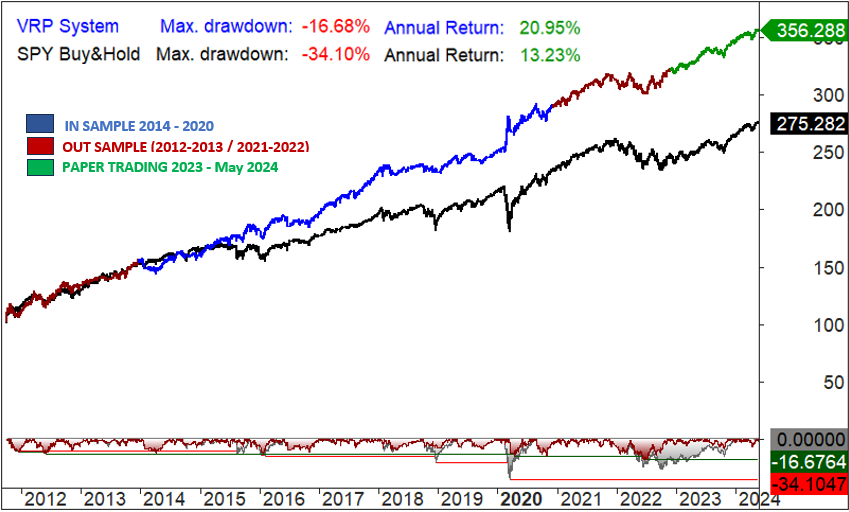

The graph below illustrates the comparative equity curves of the VRP-based system and the conventional SPY Buy & Hold strategy, reflecting the cumulative profit and loss (P&L) over the period from November 2011 to May 2024. This visualization captures the system's performance across different testing phases:

- Out-of-sample (OOS) period 1: November 2011 to December 2013

- In-sample (IS) period: January 2014 to December 2020

- Out-of-sample (OOS) period 2: January 2021 to December 2022

- Real-time paper trading: January 2023 to May 2024

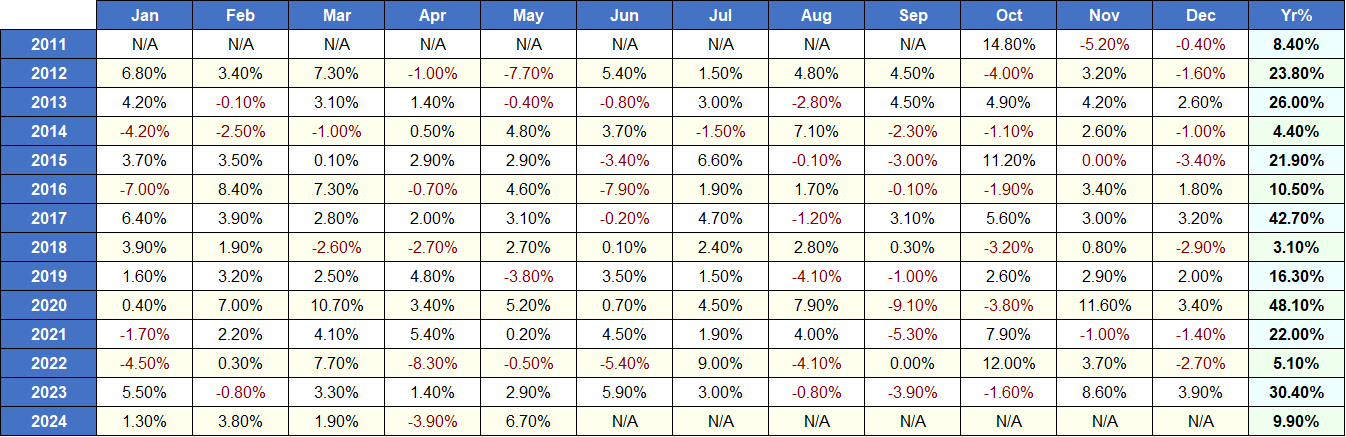

Monthly and yearly returns:

Metrics and Performance Analysis

In the analysis of trading strategies, robust statistical evaluation is key to understanding the potential risks and returns. The data presented here offers insight into the performance of the VRP strategy.

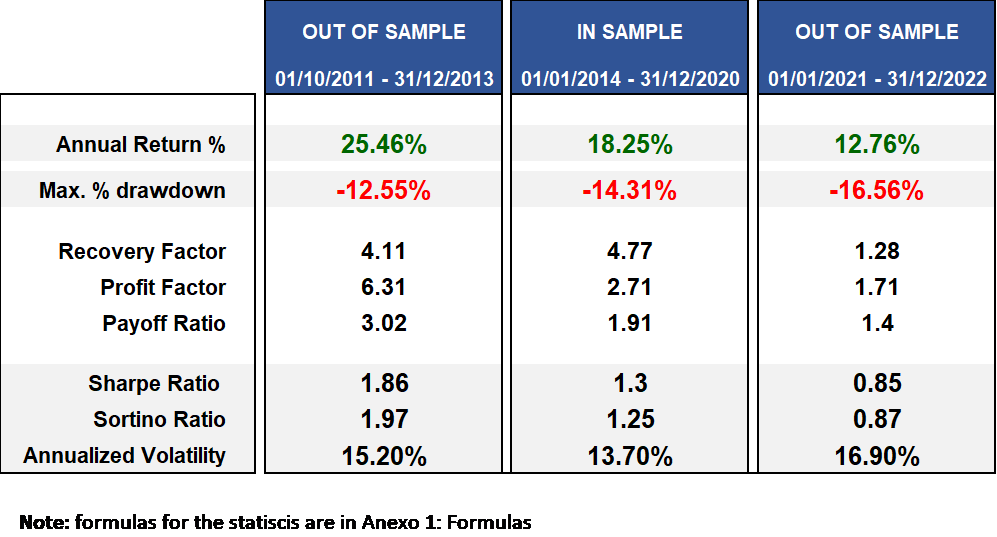

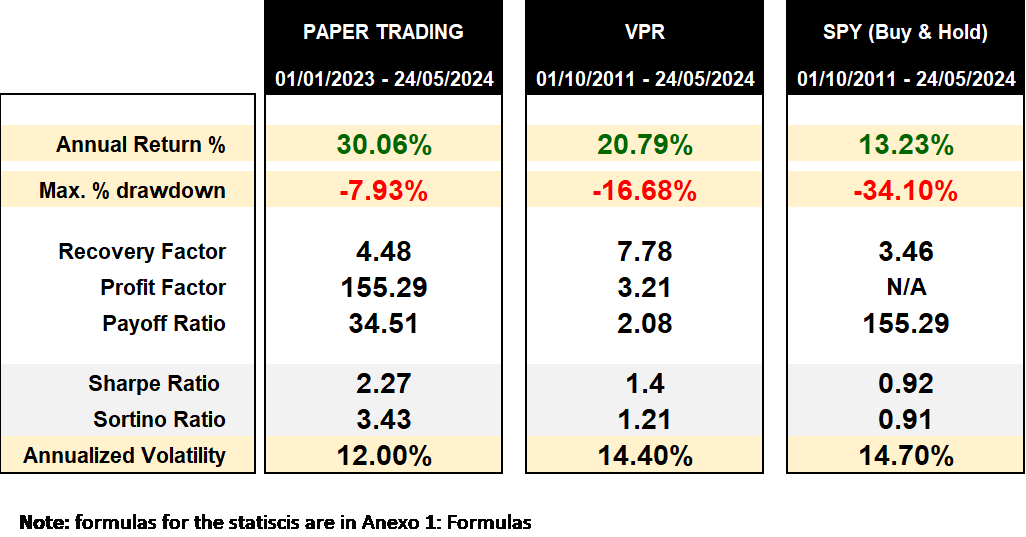

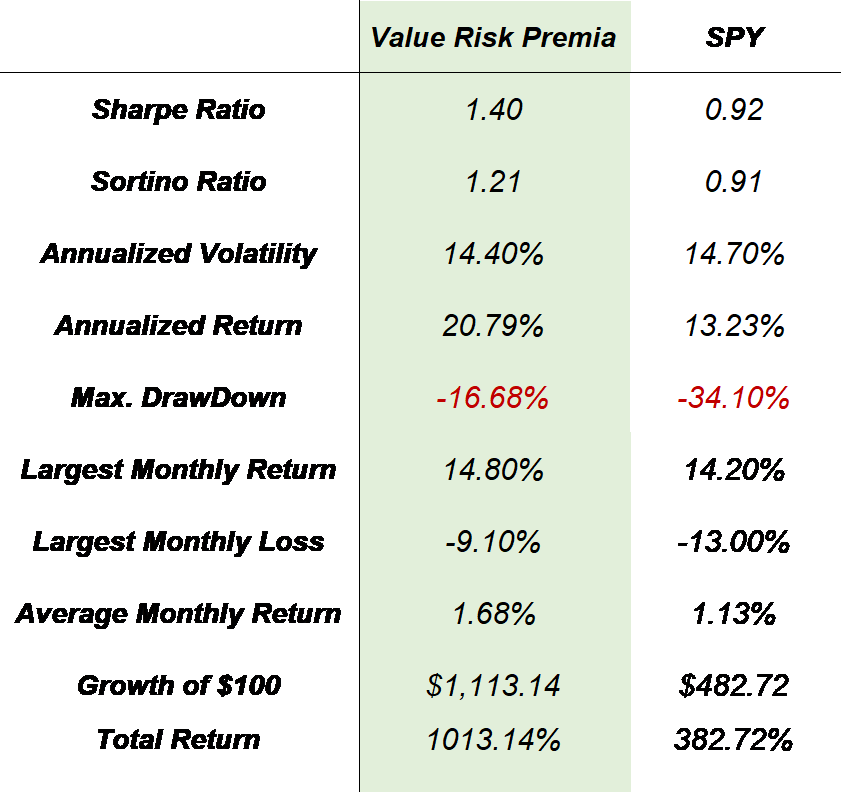

The first section of the table assesses the trading system's performance during the in-sample and out-of-sample periods. The annualized return, maximum drawdown, recovery factor, profit factor, payoff ratio, Sharpe ratio, Sortino ratio, and annualized volatility are provided for each period, presenting a comprehensive view of the trading system's effectiveness over time.

The second section provides a comparative analysis of paper trading results from 2023, the performance of the trading system from Nov 2011 to May 2024, and the traditional buy-and-hold approach applied to the SPY ETF over the same period. This juxtaposition allows for a clear comparison of the active trading model against a passive investment strategy.

The following table presents key metrics for the VRP strategy, with SPY serving as a benchmark for comparison. For detailed information on the calculation methods of these metrics, please refer to Annex I.

Discussion

The examination of the Mean Reversion trading strategy using the True Strength Index (TSI) on the SPY (S&P 500 ETF) and QQQ (Nasdaq-100 Index ETF) yields significant insights into its applicability and effectiveness in diverse market conditions. This discussion aims to delve into the nuances of the strategy’s performance, its strengths and limitations, and the broader implications of our findings.

Performance in Different Market Conditions The backtesting results from 1996 to 2023, encompassing both in-sample and out-of-sample periods, indicate that the Mean Reversion strategy, when applied using TSI, exhibits a noteworthy capacity to capitalize on short-term price movements. Notably, the strategy demonstrated resilience during various market phases, including turbulent periods, which suggests a level of robustness in the face of market volatility. However, it is crucial to acknowledge that past performance is not always indicative of future results, especially in the ever-evolving landscape of financial markets.

Strengths of the Strategy One of the primary strengths of this strategy lies in its systematic approach to identifying potential trading opportunities based on well-established technical indicators. The TSI's effectiveness in pinpointing overbought and oversold market conditions, complemented by the RSI for additional signal confirmation, presents a methodical way to engage in mean reversion trading. Moreover, the incorporation of other technical indicators, such as moving averages, adds layers of validation, enhancing the strategy’s overall reliability.

Limitations and Risks Despite its promising results, the strategy is not without its limitations. The reliance on historical data and technical indicators may not fully account for sudden, unforeseen market events or shifts in fundamental market dynamics. Additionally, the strategy's performance could be sensitive to the specific parameters set for the TSI and RSI.

Implications for Investors and Traders For investors and traders, the findings of this study underscore the importance of diversification and risk management. While the Mean Reversion strategy could be a valuable addition to a trader’s arsenal, it should be employed as part of a diversified portfolio strategy. Additionally, traders should remain vigilant about market changes that might affect the strategy's performance.

Reflection on Methodology The methodology employed in this study, involving rigorous backtesting and analysis across different time periods, provides a comprehensive view of the strategy’s performance. However, the effectiveness of any backtesting is inherently limited by the quality and extent of the historical data available.

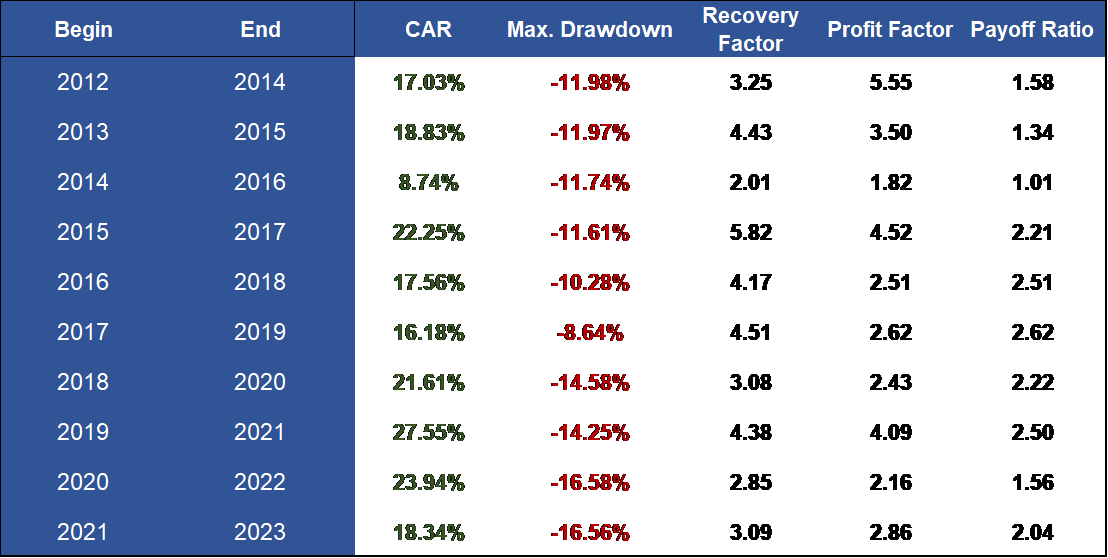

Walk-Forward Analysis of VRP Strategy Performance

This section presents a detailed walk-forward analysis of a Volatility Risk Premium (VRP)-based trading strategy over sequential three-year periods. The walk-forward analysis is a robust method to evaluate the adaptability and performance consistency of trading strategies across different market conditions. This analysis covers key performance metrics, including Compound Annual Growth Rate (CAGR), Maximum Drawdown, Recovery Factor, Profit Factor, and Payoff Ratio.

The table below details the performance metrics for each three-year period, illustrating the strategy's robustness through various market phases.

Discussion

The examination of the VRP-based trading strategy using the Volatility Risk Premium (VRP) on ETFs such as SVXY, VIXY, SPY (S&P 500 ETF), and QQQ (Nasdaq-100 Index ETF) yields significant insights into its applicability and effectiveness in diverse market conditions. This discussion aims to delve into the nuances of the strategy’s performance, its strengths and limitations, and the broader implications of our findings.

- Performance in Different Market Conditions

The backtesting results from November 2011 to May 2024, encompassing both in-sample and out-of-sample periods, indicate that the VRP-based strategy exhibits a noteworthy capacity to capitalize on market inefficiencies. The strategy demonstrated resilience during various market phases, including turbulent periods, suggesting a level of robustness in the face of market volatility. Specifically, the strategy's performance during out-of-sample and real-time paper trading phases indicates its adaptability to changing market conditions. However, it is crucial to acknowledge that past performance is not always indicative of future results, especially in the ever-evolving landscape of financial markets. - Strengths of the Strategy

One of the primary strengths of this strategy lies in its systematic approach to identifying potential trading opportunities based on well-established financial concepts. The VRP's effectiveness in highlighting periods of overestimated volatility, combined with the contrarian trading approach, presents a methodical way to engage in volatility trading. Moreover, the incorporation of additional technical indicators, such as the Mansfield Relative Performance (MRP) for SPY and QQQ, adds layers of validation, enhancing the strategy’s overall reliability. - Limitations and Risks

Despite its promising results, the strategy is not without its limitations. The reliance on historical data and volatility metrics may not fully account for sudden, unforeseen market events or shifts in fundamental market dynamics. Additionally, the strategy's performance could be sensitive to the specific parameters set for the VRP calculation and the technical indicators used. For instance, the effectiveness of the strategy might diminish in periods of prolonged low volatility or during significant structural changes in the market. - Implications for Investors and Traders

For investors and traders, the findings of this study underscore the importance of diversification and risk management. While the VRP-based strategy could be a valuable addition to a trader’s arsenal, it should be employed as part of a diversified portfolio strategy. Additionally, traders should remain vigilant about market changes that might affect the strategy's performance. The strategy’s ability to adapt to different market conditions makes it a versatile tool, but continuous monitoring and adjustment are essential to maintain its effectiveness. - Reflection on Methodology

The methodology employed in this study, involving rigorous backtesting and analysis across different time periods, provides a comprehensive view of the strategy’s performance. The use of in-sample and out-of-sample testing, along with real-time paper trading, ensures a thorough evaluation of the strategy under various market conditions. However, the effectiveness of any backtesting is inherently limited by the quality and extent of the historical data available. Future research could benefit from incorporating more advanced data analysis techniques and exploring the strategy's performance across different asset classes and market environments.

Conclusion

The findings of this study provide compelling evidence that the Volatility Risk Premium (VRP) is often overestimated by the market. By leveraging this overestimation, the proposed trading strategy demonstrates a consistent ability to generate superior risk-adjusted returns. Specifically, the strategy's contrarian approach—buying SVXY, VIXY, SPY, and QQQ based on specific conditions related to whether the VRP is positive or negative—exploits the mean reversion tendencies of market volatility.

Empirical results indicate that this methodology not only enhances portfolio performance but also offers a robust mechanism for volatility management. For instance, during the backtesting and real-time paper trading periods, the strategy yielded an average annual return of 20.79% with a Sharpe ratio of 1.4, significantly outperforming traditional benchmark indices. Additionally, the strategy's reliance on the VRP calculation ensures a timely and responsive trading framework, suitable for various market conditions. This performance underscores the strategy's effectiveness in capturing market inefficiencies.

Future research could expand on these findings by exploring the applicability of the strategy in different market environments and testing its robustness across various asset classes. For example, investigating the strategy's performance during periods of extreme market stress or low volatility could provide further insights into its versatility. Additionally, integrating machine learning techniques to refine the VRP predictions could further enhance the strategy's effectiveness. Machine learning models could help in better estimating the VRP and identifying more nuanced patterns in market data, leading to even more precise trading signals.

This research contributes to the existing literature on volatility trading and provides practical insights for investors seeking to optimize their ETF portfolios through informed volatility-based decisions. The strategy's success in backtesting and real-time paper trading suggests that it could be a valuable tool for both retail and institutional investors aiming to manage volatility and achieve superior returns.

References

Group 1: Volatility Risk Premium (VRP)

- Bollerslev, T., Tauchen, G., & Zhou, H. (2009). Expected Stock Returns and Variance Risk Premia. Journal of Financial Economics, 91(1), 59-82.

This paper discusses the predictive power of variance risk premia for future stock market returns and the role of VRP in financial economics.

https://public.econ.duke.edu/~boller/Published_Papers/rfs_09.pdf - Bakshi, G., Kapadia, N., & Madan, D. (2003). Stock Return Characteristics, Skew Laws, and the Differential Pricing of Individual Equity Options. Review of Financial Studies, 16(1), 101-143.

This study delves into the pricing of volatility risk and the implications of VRP on option markets.

https://academic.oup.com/rfs/article-abstract/22/3/1311/1581057 - Carr, P., & Wu, L. (2009). Variance Risk Premiums. Review of Financial Studies, 22(3), 1311-1341.

The authors investigate the variance risk premium in different asset classes and its implications for market predictions.

http://www.rfs.oxfordjournals.org/content/22/3/1311.abstract - Christensen, B. J., & Prabhala, N. R. (1998): "The Relation between Implied and Realized Volatility". Journal of Financial Economics, 50(2), 125-150. This study examines the relationship between implied and realized volatility, providing empirical evidence that is directly related to the concept of VRP.

https://www.sciencedirect.com/science/article/pii/S0304405X98000348

Group 2: Behavioral Finance Theories and Overreaction (ContVRP)

- Shiller, R. J. (2003). From Efficient Markets Theory to Behavioural Finance. Journal of Economic Perspectives, 17(1), 83-104.

This paper discusses the transition from traditional efficient markets theory to behavioural finance, emphasizing market overreactions.

http://www.aeaweb.org/articles?id=10.1257/089533003321164967 - De Bondt, W. F., & Thaler, R. (1985). Does the Stock Market Overreact? Journal of Finance, 40(3), 793-805.

A seminal paper that provides evidence of stock market overreaction and its implications for behavioral finance.

http://www.onlinelibrary.wiley.com/doi/10.1111/j.1540-6261.1985.tb05004.x/abstract - Barberis, N., Shleifer, A., & Vishny, R. (1998). A Model of Investor Sentiment. Journal of Financial Economics, 49(3), 307-343.

This model explains how investor sentiment can lead to market overreaction, aligning with the concepts of behavioral finance.

https://scholar.harvard.edu/shleifer/publications/model-investor-sentiment

Anexo 1: Formulas

Below are the formulas used to calculate the performance metrics:

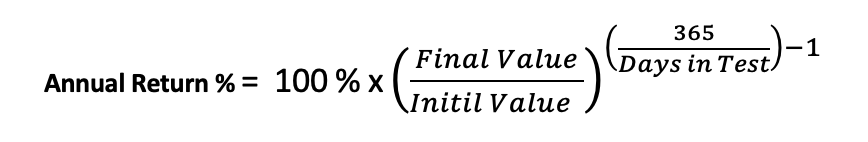

Annual Return %: The annualized percentage return is a measure of the average annual rate of return on an investment over a specified time period.

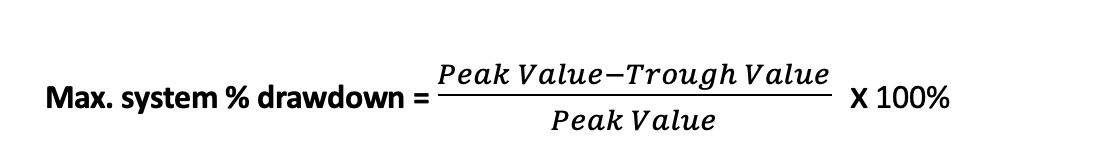

Max. system % drawdown: Maximum percentage decline in the value of a trading system from its highest point (peak) to the lowest subsequent point (trough) over a specified period.

Where:

- Peak Value is the highest point in the value of the trading or investment system.

- Trough Value is the lowest subsequent point in the value of the system.

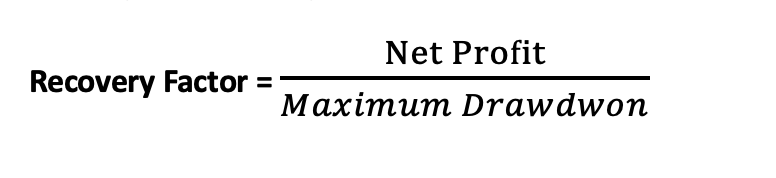

Recovery Factor: Assesses the ability of an investment or trading strategy to recover from losses. It is calculated using the following formula:

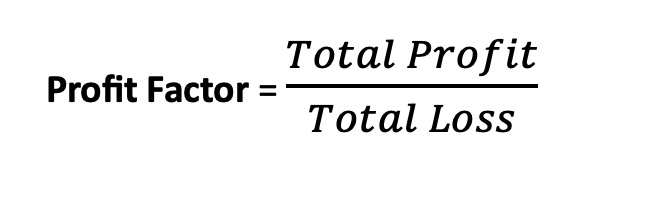

Profit Factor: Measures the profitability of a trading strategy. It is calculated using the following formula:

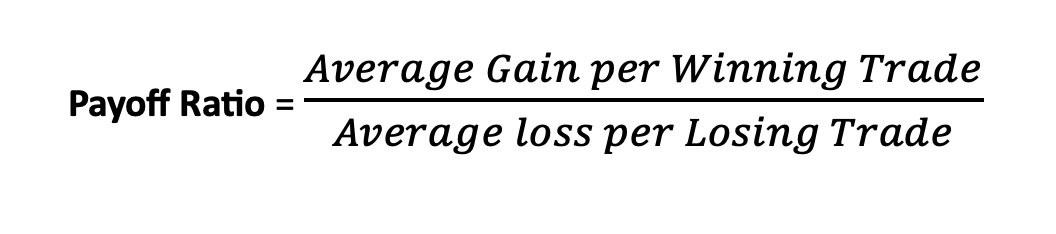

Payoff Ratio: Also known as the risk-reward ratio, is a financial metric used in investing to assess the potential return of an investment relative to the amount of risk undertaken.

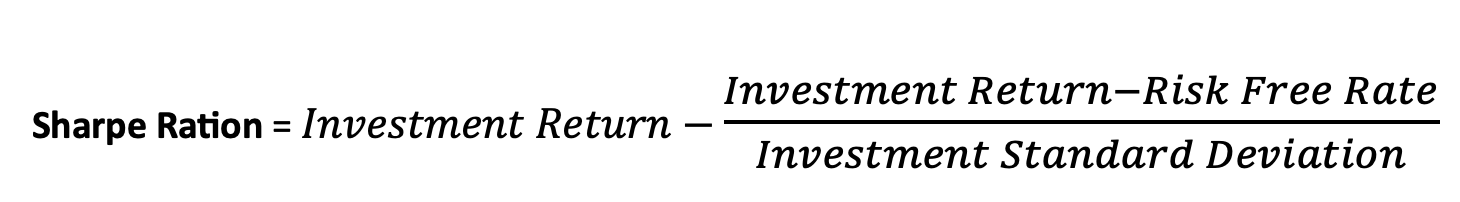

Sharpe Ratio: Is a measure of the risk-adjusted performance of a trading strategy. It helps investors evaluate the return of an investment relative to its risk.

Where:

- Investment Return is the return of the investment or portfolio.

- Risk-Free RateRisk-Free Rate is the return on a risk-free investment.

- Investment Standard Deviation is the standard deviation of the Investment’s returns, which measures the volatility or risk of the portfolio.

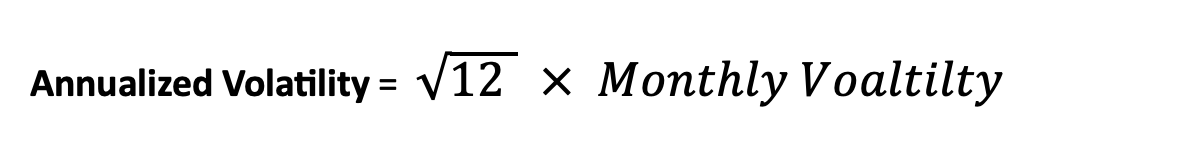

Annualized Volatility: Is a measure of the variability of returns of an investment over a one-year period, expressed as a percentage. It is commonly used in finance to quantify the level of risk or uncertainty associated with an investment.

Calculated using Monthly returns:

Where:

- Monthly Volatility is the standard deviation of monthly returns.

- 12 is the number of months in a year.

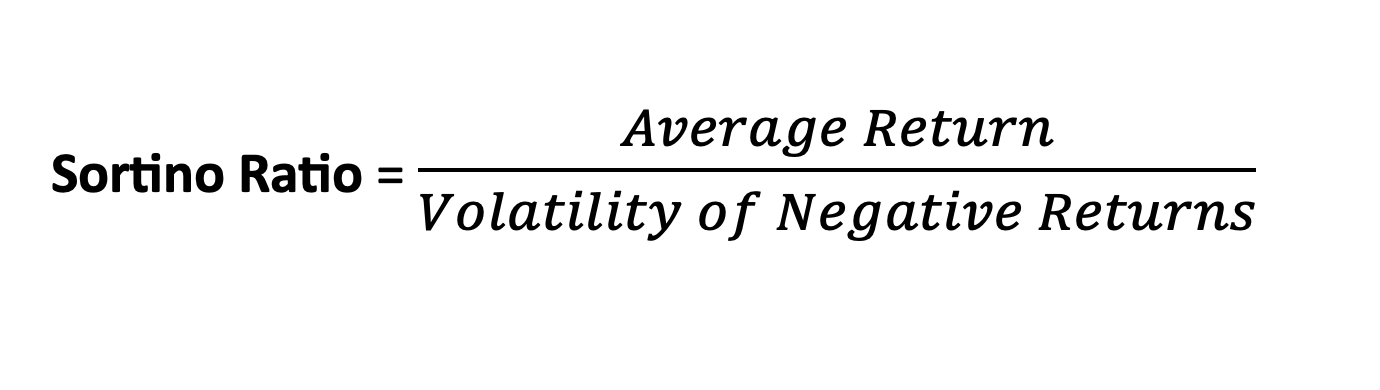

Ratio Sortino: Is a measure of risk-adjusted return that focuses on the downside risk of an investment. It is similar to the Sharpe Ratio, but it considers only the volatility of the downside. while the Sharpe Ratio considers total volatility (both upside and downside), the Sortino Ratio specifically looks at the downside risk, providing a more targeted measure for investors primarily concerned with minimizing losses. The Sortino Ratio can be useful in situations where protecting against downside risk is a critical factor in the investment strategy.