Our Service Providers

Common Problems

Are You Struggling to Grow Your Assets Under Management?

Well designed investment strategies target higher returns and build in protections against unexpected downturns and catastrophic events. Unfortunately, most managers have hard time growing assets due to::

- Long sales cycle

- Gate keepers and ineffient capital allocation

- Lack of marketing and distribution channels

- Operational complexity

- Regulatory environment

The Solution

CARL is an Investment Fund Infrastructure and Technology Platform

CARL through its platform, provides all the required infrastructure required to operate an investment fund. Our market-place and infrastructure services makes it easy to offer and invest in alternative investments.

- Managers grow AUM faster

- Digital distribution marketing channel

- Reduce sales cycle

- Direct to investor (B2C)

- Direct to advisor (B2B2C)

- Increase capital allocation efficiency

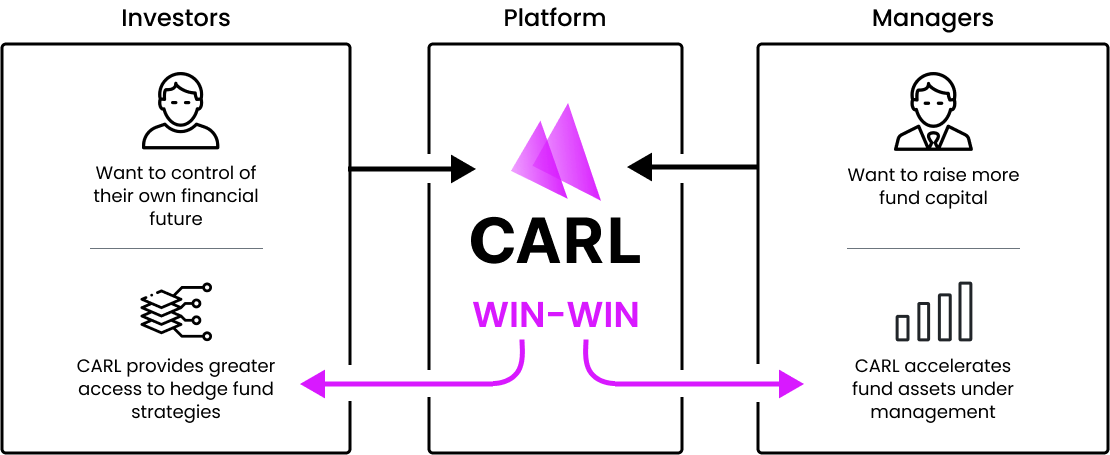

Win-Win

Providing an Operational Efficient Investor-Manager-Relationship

The CARL platform connects tech savvy investors that embrace technology with fund managers to generate benefits for both investors and fund managers. Reducing friction and accelerating capital allocation.

Investors

- CARL aggregates small investments from tech savvy investors that previously did not have access to hedge fund investments.

- Investors can invest at low minimums of $20K and build a diversified portfolio of sophisticated quant hedge fund strategies.

- Through CARL's mobile applications investors are able to find strategies that fit their risk tolerance and return expectations right at their fingertips.

Managers

- CARL white labels selected strategies and ensures that only the best investment opportunities are offered via our platform.

- The CARL platform automates marketing, onboarding, KYC, AML, accreditation, ID verification, banking integration, mid-office, back-office, complience, taxes, allocation, administration, etc.

- Managers are able to grow assets under management without having to rely solely on traditional institutional investors.

Our Strategies

Discover Our Alternative Investment Opportunities

CARL will partner with existing asset managers to make their investment opportunities available through its platform. Partners are evaluated on their operations as well as a scientific, data-driven evaluation of their investment strategies. The goal is to provide portfolios with low inter-fund correlation, high expected returns, and low equity market correlation. We strive to provide diversification and are constantly looking for managers with different and unique ideas.

How to Partner With CARL

Our Quick and Easy Origination Process

CARL's philosophy is reducing friction for both our investors and our managers. From accredited investor certification to broker and bank API integrations to manager onboarding, much of the process has been automated to ensure accuracy, efficiency, and ease for all stakeholders.

Initiation & Due Diligence

Our team will evaluate and vet the trading strategy, drawing upon decades of combined institutional experience spanning trading, portfolio management, manager selection, payments processing, and software development.

Funding

Within 3 to 4 months, the new US-domiciled CARL hedge fund vehicle will break escrow and commence live trading as monthly subscriptions are now available to CARL's expansive accredited investor base.

Servicing Activities

Ongoing activities such as marketing, regulatory filings, investor relations, tax documentation, etc. are all managed by CARL thereby leaving the portfolio manager to solely concentrate on generating alpha.

Let's Talk?

If you are an experienced fund manager and would like to partner with CARL, we’d love to hear from you.