Abstract

This paper presents a detailed examination of a mean reversion trading strategy centered around the True Strength Index (TSI), applied to the SPY (S&P 500) and QQQ (Nasdaq Index). The strategy's robustness is thoroughly evaluated through an extensive analysis covering historical data from 1996 to 2022. This includes a critical assessment during out-of-sample periods and paper trading to ensure a comprehensive understanding of its performance across different market conditions. Key performance metrics scrutinized include Compound Annual Growth Rate (CAGR), Maximum Drawdown (Max DD), Sharpe Ratio, and Sortino Ratio. These metrics provide insight into the strategy's profitability, its risk management efficiency, and overall effectiveness. The study aims to contribute to the existing body of knowledge in financial market trading strategies, offering a nuanced perspective on the applicability and sustainability of mean reversion strategies in the dynamic landscape of equity markets.

Introduction

The study introduces a mean reversion strategy, focusing on the TSI as the main indicator. This strategy aims to capitalize on short price movements (average 5 days) reverting to a mean value. The paper outlines the strategy's premise and its application in diverse market conditions. This strategy is implemented on the QQQ ETF and SPY ETF.

- QQQ: Invesco QQQ Trust, is an exchange-traded fund that tracks the performance of the Nasdaq-100 Index.

- SPY: SPDR S&P 500 ETF Trust, is an exchange-traded fund that seeks to track the performance of the S&P 500 Index.

Methodology

The trading system implemented in this research generates open and close signals, with the execution of trades occurring at the market close. Positions are subsequently initiated or liquidated at the opening market price of the following trading day.

Data Partitioning:

For the assurance of the trading system's robustness and dependability, we divided the historical ETF data spanning from January 1996 to December 2022 into two datasets: in-sample and out-of-sample.

- The in-sample dataset, which is pivotal for the development of the model, comprises the years 2000 to 2018.

- The out-of-sample dataset, serving for an unbiased evaluation of the model, is segregated into two periods: 1996 to 1999 and 2019 to 2022.

- The strategy's efficacy has been preliminarily tested through paper trading commencing in January 2023.

Strategy Outline and Auxiliary Indicators:

Central to our strategy is the True Strength Index (TSI), a momentum oscillator adept at identifying mean reversion opportunities. The TSI's role is crucial in detecting conditions where the market is considered overbought or oversold, signaling potential price corrections. For the purposes of this study, we focus on long positions during oversold conditions as indicated by the TSI.

In support of the TSI, the Relative Strength Index (RSI) is employed as a secondary filter. The RSI aids in affirming the trading signals generated by the TSI by identifying points where price movements may be reaching an extremity, indicative of potential trend reversals. The concurrent use of TSI and RSI seeks to refine the accuracy of trade signals and reduce the incidence of false triggers.

Additional indicators are integrated to provide secondary decision support, evaluating market volatility and assisting in the determination of strategic exit points. This is critical to the strategy's risk management, ensuring alignment with the prevailing market dynamics.

Furthermore, the strategy leverages additional technical indicators, such as moving averages for trend analysis and bespoke oscillators for specific market conditions, to further refine the generated signals. This combination provides a multi-faceted framework designed to capture mean reversion opportunities while managing risk effectively.

It is noteworthy that while the strategy is specifically tailored to trading the SPY (S&P 500 ETF) and QQQ (Nasdaq-100 Index ETF), it possesses the flexibility to be adapted for trading the associated futures.

Backtesting Results, Returns and Metrics

In this section, we meticulously dissect the performance of the Mean Reversion strategy using the True Strength Index (TSI) through rigorous backtesting. This section is pivotal in translating theoretical constructs into empirical evidence, providing a clear picture of how the strategy fares in the practical realm of financial markets.

This section aims to furnish a comprehensive understanding of the strategy's historical performance, offering valuable insights into its potential applicability and effectiveness in varying market conditions.

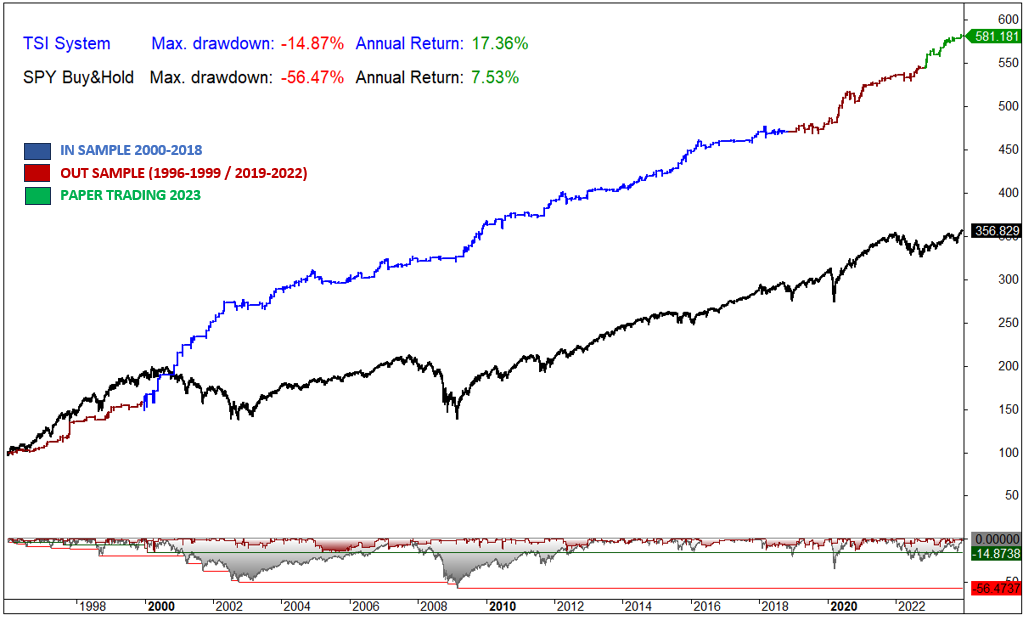

The graph below illustrates the comparative equity curves of the TSI System and the conventional SPY Buy & Hold strategy, reflecting the cumulative profit and loss (P&L) over the period from 1996 to 2023. This visualization captures the system's performance across in-sample testing, out-of-sample validation, and real-time paper trading scenarios.

Metrics and Performance Analysis

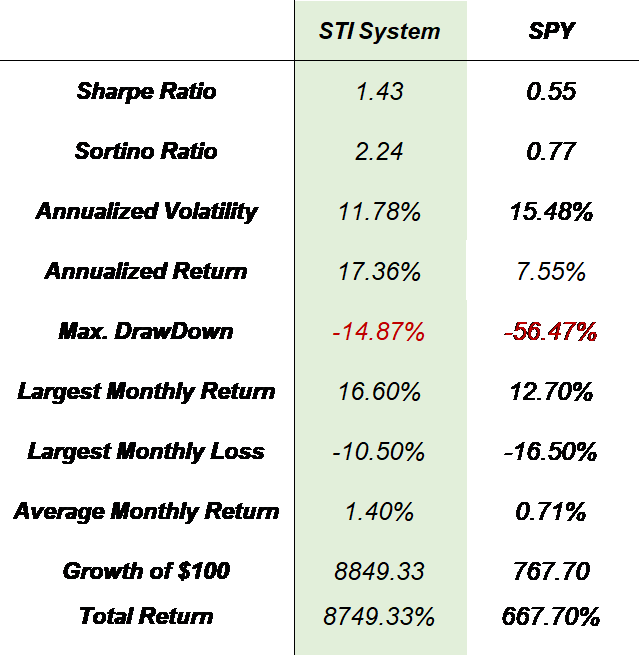

In the analysis of trading strategies, robust statistical evaluation is key to understanding the potential risks and returns. The data presented here offers insight into the performance of the TSI strategy.

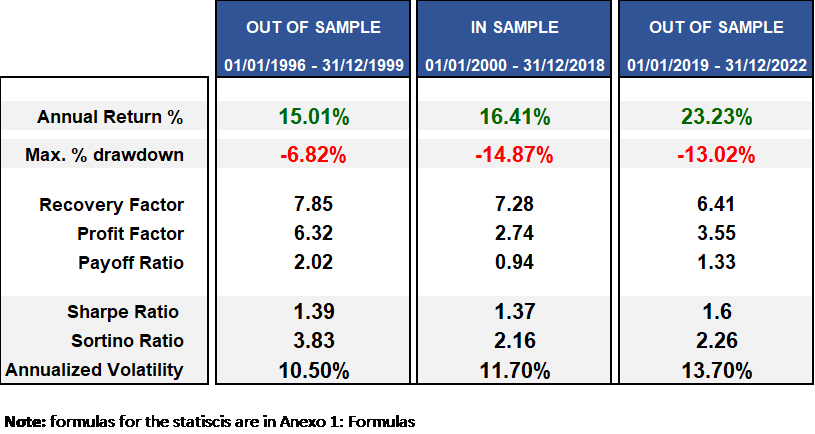

The first section of the table assesses the trading system's performance during the in-sample and out-of-sample periods. The annualized return, maximum drawdown, recovery factor, profit factor, payoff ratio, Sharpe ratio, Sortino ratio, and annualized volatility are provided for each period, presenting a comprehensive view of the trading system's effectiveness over time.

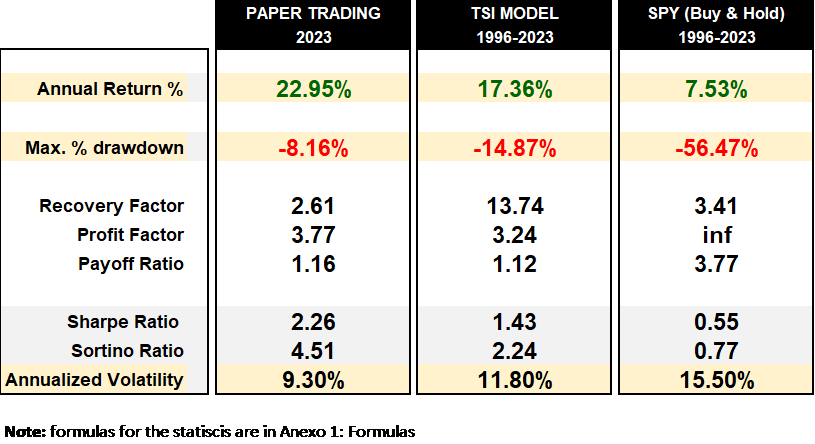

The second section provides a comparative analysis of paper trading results from 2023, the performance of the trading system from 1996 to 2023, and the traditional buy-and-hold approach applied to the SPY ETF over the same period. This juxtaposition allows for a clear comparison of the active trading model against a passive investment strategy.

The following table presents key metrics for the TSI strategy, with SPY serving as a benchmark for comparison. For detailed information on the calculation methods of these metrics, please refer to Annex I.

Walk-Forward Analysis of TSI Strategy Performance

The table presents a detailed walk-forward analysis of a TSI-based trading strategy over sequential three-year periods, delineating the strategy's adaptability and robustness through various market conditions. The results encapsulate key performance metrics, including Compound Annual Growth Rate (CAR), Maximum Drawdown, Recovery Factor, Profit Factor, and Payoff Ratio, highlighting the strategy's efficacy during both in-sample development phases and out-of-sample testing intervals.

Discussion

The examination of the Mean Reversion trading strategy using the True Strength Index (TSI) on the SPY (S&P 500 ETF) and QQQ (Nasdaq-100 Index ETF) yields significant insights into its applicability and effectiveness in diverse market conditions. This discussion aims to delve into the nuances of the strategy’s performance, its strengths and limitations, and the broader implications of our findings.

Performance in Different Market Conditions The backtesting results from 1996 to 2023, encompassing both in-sample and out-of-sample periods, indicate that the Mean Reversion strategy, when applied using TSI, exhibits a noteworthy capacity to capitalize on short-term price movements. Notably, the strategy demonstrated resilience during various market phases, including turbulent periods, which suggests a level of robustness in the face of market volatility. However, it is crucial to acknowledge that past performance is not always indicative of future results, especially in the ever-evolving landscape of financial markets.

Strengths of the Strategy One of the primary strengths of this strategy lies in its systematic approach to identifying potential trading opportunities based on well-established technical indicators. The TSI's effectiveness in pinpointing overbought and oversold market conditions, complemented by the RSI for additional signal confirmation, presents a methodical way to engage in mean reversion trading. Moreover, the incorporation of other technical indicators, such as moving averages, adds layers of validation, enhancing the strategy’s overall reliability.

Limitations and Risks Despite its promising results, the strategy is not without its limitations. The reliance on historical data and technical indicators may not fully account for sudden, unforeseen market events or shifts in fundamental market dynamics. Additionally, the strategy's performance could be sensitive to the specific parameters set for the TSI and RSI.

Implications for Investors and Traders For investors and traders, the findings of this study underscore the importance of diversification and risk management. While the Mean Reversion strategy could be a valuable addition to a trader’s arsenal, it should be employed as part of a diversified portfolio strategy. Additionally, traders should remain vigilant about market changes that might affect the strategy's performance.

Reflection on Methodology The methodology employed in this study, involving rigorous backtesting and analysis across different time periods, provides a comprehensive view of the strategy’s performance. However, the effectiveness of any backtesting is inherently limited by the quality and extent of the historical data available.

Conclusion

In summarizing the insights garnered from our extensive study of the Mean Reversion strategy using the True Strength Index (TSI) applied to SPY and QQQ ETFs, it becomes evident that this strategy has considerable potential in the realm of financial trading. The backtesting results spanning from 1996 to 2023 reveal that the strategy can effectively capitalize on short-term price movements under varying market conditions. This underscores its robustness and potential viability as a component of a diverse trading approach.

Key to the appeal of this strategy is its systematic utilization of established technical indicators like TSI and RSI, which have demonstrated their utility in identifying meaningful trading opportunities.

Looking ahead, this paper lays a foundation for further exploration within the domain of financial trading strategies. Future research directions could include the integration of more sophisticated analytical tools, the application of this strategy across a broader array of financial instruments, and testing in real-time market conditions. Such advancements could provide deeper insights and enhance the applicability of mean reversion strategies in financial markets.

Ultimately, this research contributes to the ongoing discourse in the field of financial trading and strategy development. It reaffirms the potential of the Mean Reversion strategy using TSI, while also highlighting the importance of continuous learning, adaptation, and cautious integration into broader investment practices. This balanced approach is crucial for navigating the complexities and uncertainties of the financial markets, and for achieving sustainable trading success.

Anexo 1: Formulas

Below are the formulas used to calculate the performance metrics:

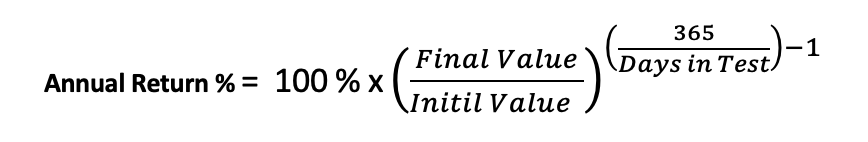

Annual Return %: The annualized percentage return is a measure of the average annual rate of return on an investment over a specified time period.

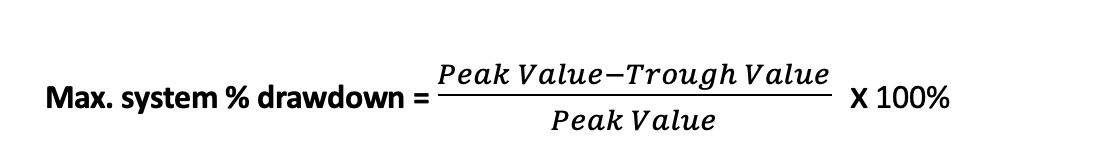

Max. system % drawdown: Maximum percentage decline in the value of a trading system from its highest point (peak) to the lowest subsequent point (trough) over a specified period.

Where:

- Peak Value is the highest point in the value of the trading or investment system.

- Trough Value is the lowest subsequent point in the value of the system.

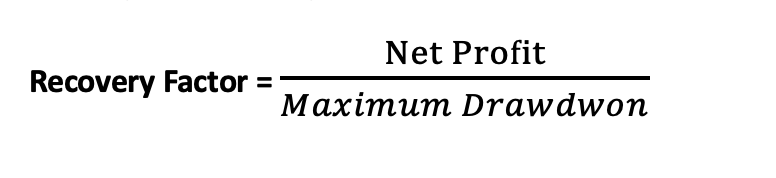

Recovery Factor: Assesses the ability of an investment or trading strategy to recover from losses. It is calculated using the following formula:

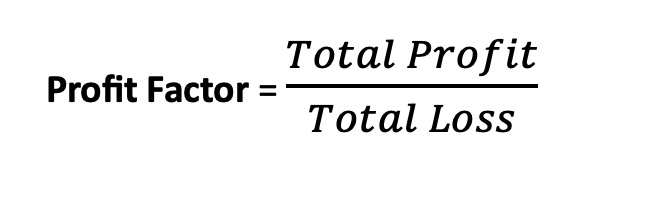

Profit Factor: Measures the profitability of a trading strategy. It is calculated using the following formula:

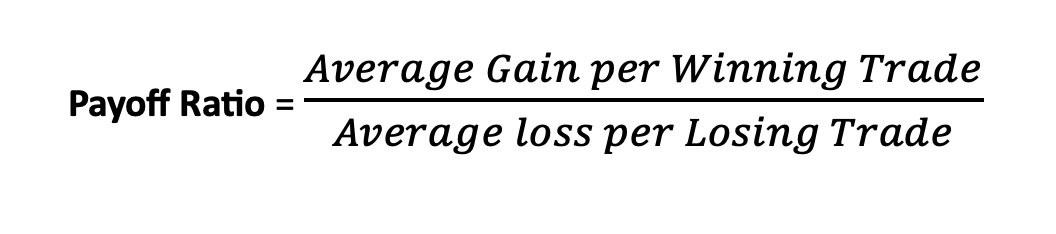

Payoff Ratio: Also known as the risk-reward ratio, is a financial metric used in investing to assess the potential return of an investment relative to the amount of risk undertaken.

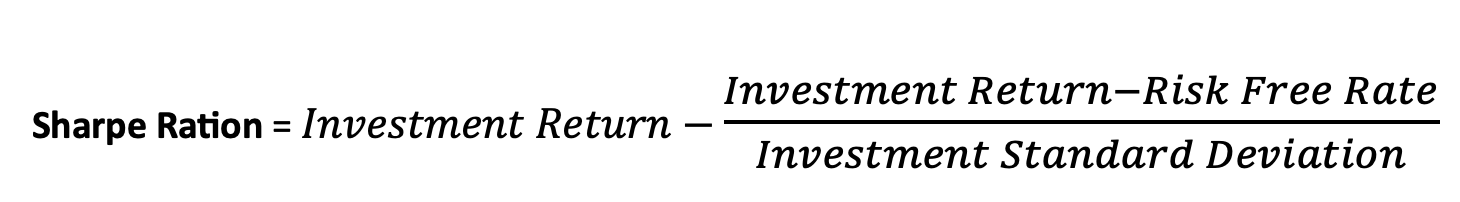

Sharpe Ratio: Is a measure of the risk-adjusted performance of a trading strategy. It helps investors evaluate the return of an investment relative to its risk.

Where:

- Investment Return is the return of the investment or portfolio.

- Risk-Free RateRisk-Free Rate is the return on a risk-free investment.

- Investment Standard Deviation is the standard deviation of the Investment’s returns, which measures the volatility or risk of the portfolio.

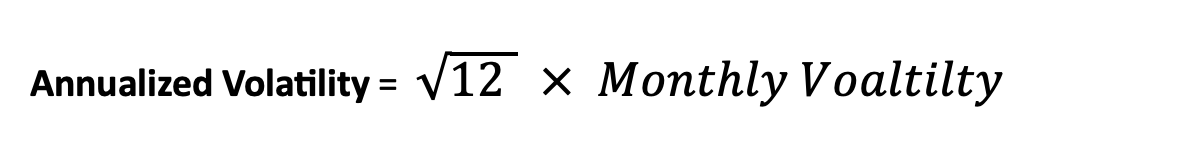

Annualized Volatility: Is a measure of the variability of returns of an investment over a one-year period, expressed as a percentage. It is commonly used in finance to quantify the level of risk or uncertainty associated with an investment.

Calculated using Monthly returns:

Where:

- Monthly Volatility is the standard deviation of monthly returns.

- 12 is the number of months in a year.

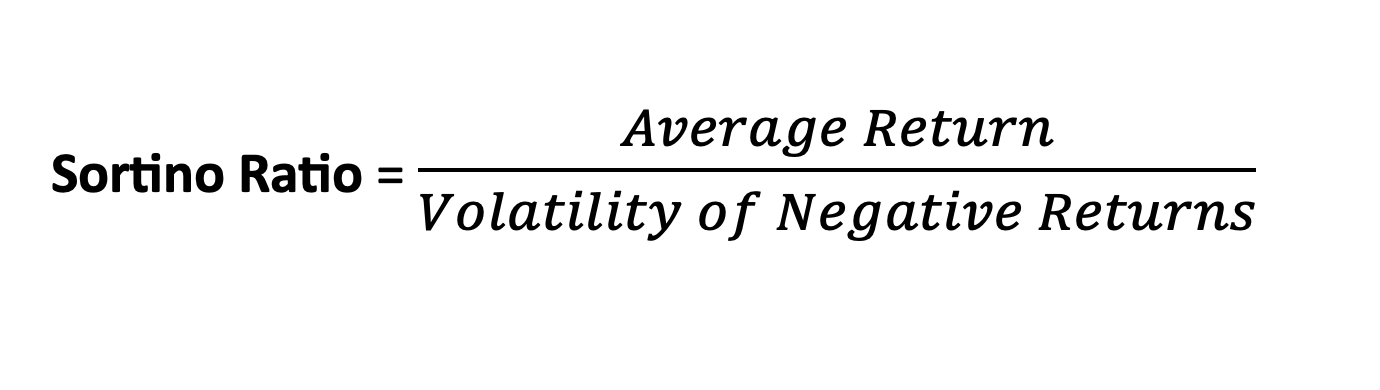

Ratio Sortino: Is a measure of risk-adjusted return that focuses on the downside risk of an investment. It is similar to the Sharpe Ratio, but it considers only the volatility of the downside. while the Sharpe Ratio considers total volatility (both upside and downside), the Sortino Ratio specifically looks at the downside risk, providing a more targeted measure for investors primarily concerned with minimizing losses. The Sortino Ratio can be useful in situations where protecting against downside risk is a critical factor in the investment strategy.