Abstract

This paper introduces a comprehensive trading model, harnessing the strengths of three distinct strategies—Swing Trading, Asset Allocation, and an Enhanced Lazy Portfolio. Through the integration of these uncorrelated strategies, the model seeks a well-rounded and diversified approach to financial markets. Utilizing historical market data, the study assesses the performance and synergy of these strategies, providing insights into the potential benefits of adopting a multifaceted trading approach.

Furthermore, the inclusion of a market risk filter enhances capital allocation decisions, particularly in optimizing each strategy's contribution under specific market conditions. This element plays a pivotal role in constructing a portfolio that strives to emulate the Optimal Efficient Portfolio's performance, aligning closely with the Efficient Frontier's objectives. The analysis explores the combined impact of these strategies and the market risk filter in creating a dynamic and adaptable portfolio management solution, suitable for diverse market environments. The paper aims to demonstrate how this integrated approach can offer a comprehensive solution for portfolio management in various market conditions.

Introduction

In the fluid and ever-changing financial markets, adaptability and strategic alignment with proven investment principles, like those of the Efficient Frontier, are key to successful trading.

This paper delves into a comprehensive trading model that blends Swing Trading, Asset Allocation, and an Enhanced Lazy Portfolio, all guided by a market risk filter. This model not only adapts to market volatility but also seeks to emulate the performance characteristics of the Optimal Efficient Portfolio, as defined by the Efficient Frontier. The integration of these strategies and the market risk filter aims to enhance the overall performance and resilience of the portfolio, offering a robust solution for navigating the complexities of the financial markets in various conditions.

Trading Strategies

1. Swing Trading Strategy:

The swing trading component of the model aims to capitalize on short to medium-term price movements within an overarching trend by identifying opportune entry and exit points for both long and short trades. For an understanding of this strategy, refer to the paper:

papers.ssrn.com/sol3/papers.cfm

2. Asset Allocation Strategy:

The asset allocation strategy focuses on distributing investments across different asset classes to achieve a balanced and diversified portfolio. Through strategic allocation based on market conditions and risk tolerance, this strategy aims to optimize returns while managing overall portfolio risk. Asset allocation contributes a risk mitigation element to the holistic model. The specific model used is described in this paper:

papers.ssrn.com/sol3/papers.cfm

3. Improved Lazy Portfolio Management:

Building upon a Lazy portfolio, the active portfolio management component incorporates monthly rebalancing and a risk assessment approach to dynamically allocate capital based on market risks. This enhances the model's adaptability in dynamic market environments. Refer to this paper for details:

papers.ssrn.com/sol3/papers.cfm

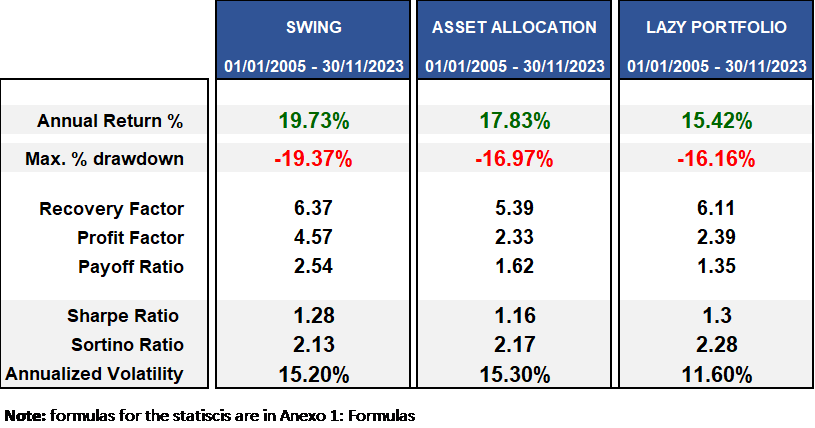

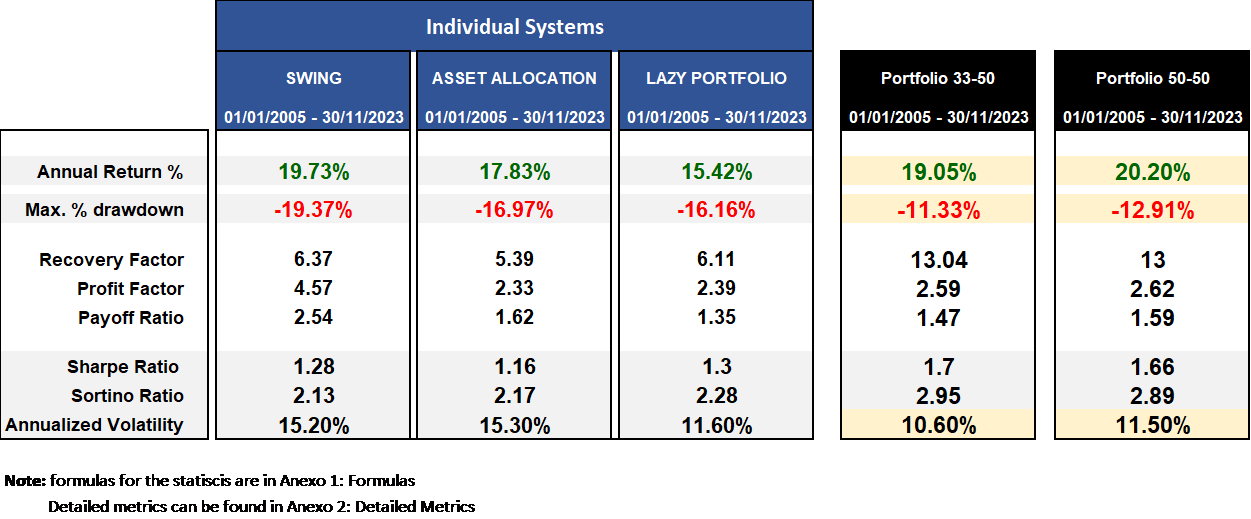

As demonstrated in the previously mentioned papers, the results metrics for the three individual strategies are (*) Data from Yahoo Finance from 01-01-2005 until 30-11-2023):

(*) The results for the three models are based on data spanning from January 1, 2005, to November 30, 2023. This specific timeframe was selected due to the use of certain ETFs in the analysis, which initiated trading activities in that year.

Holistic Model Methodology

In the Holistic Model (called from now Quantitative Portfolio Resilient), capital is allocated across these three strategies in two distinct scenarios. The first scenario involves an equal distribution of 33% in each strategy, providing a balanced and diversified foundation. In the second scenario, the model introduces a market filter designed to assess the optimal times to activate or deactivate specific strategies based on market risks perception. This dynamic filter aims to enhance adaptability by reallocating capital based on identified market conditions, potentially improving overall performance. The Holistic Model Description explores the intricate interplay of these strategies, offering insights into their collective strength and adaptability in different market scenarios.

Study 1 - Equal Distribution (33% Allocation)

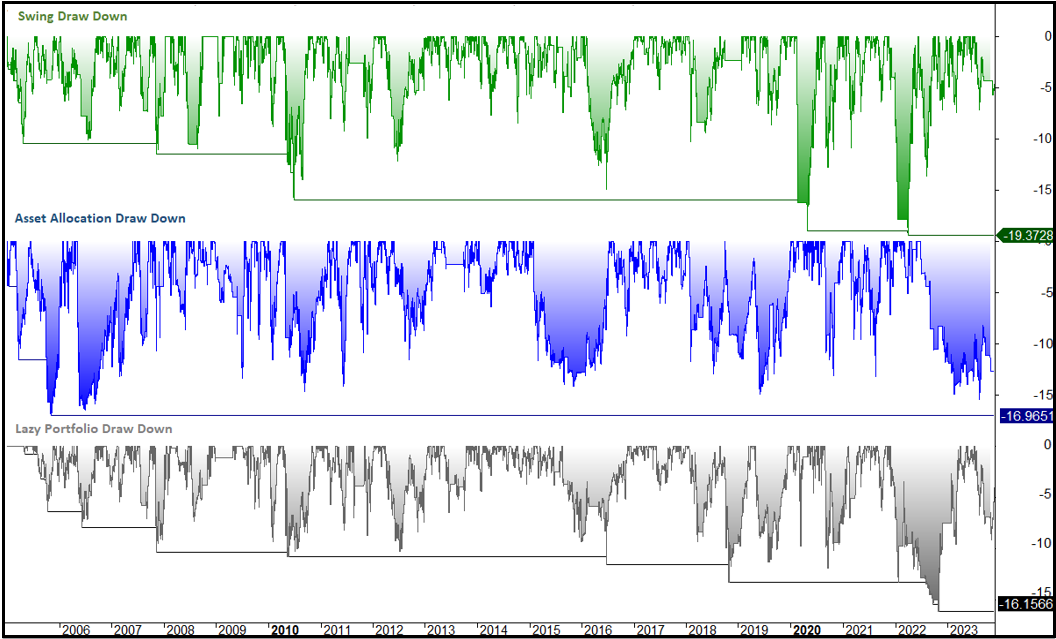

Analysis of the drawdowns of the three strategies, as illustrated in Figure 1, indicates that the maximum drawdown for each strategy occurs at distinct points in time. This observation suggests that combining the three strategies into a portfolio, with an allocation of 33% of the capital for each, has the potential to mitigate the overall maximum drawdown without significant penalty on the returns. This is referred to as Portfolio 33.

Fig.1 Illustrates the Draw Down profile of the three strategies:

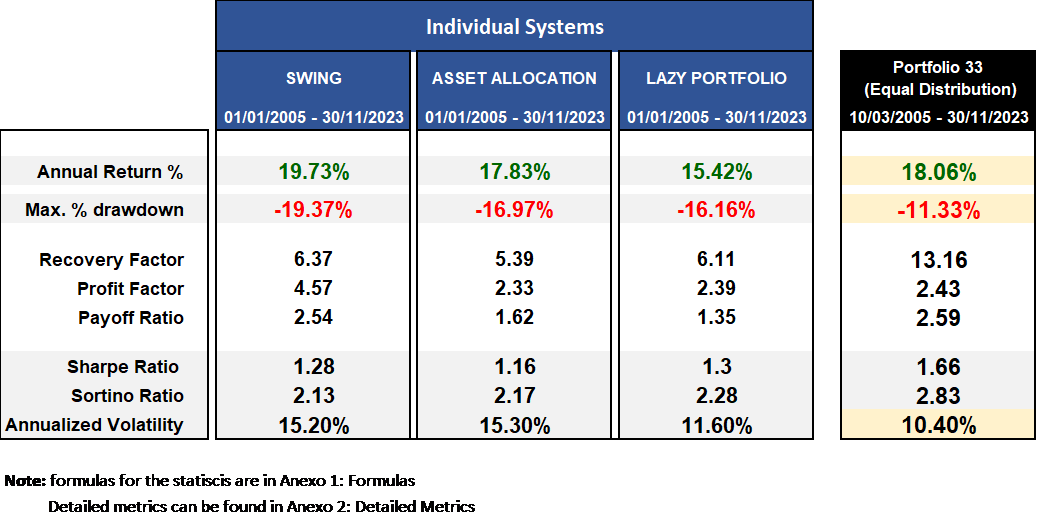

Backtesting Results for Study 1: Portfolio of Systems with Equal Distribution

Metrics:

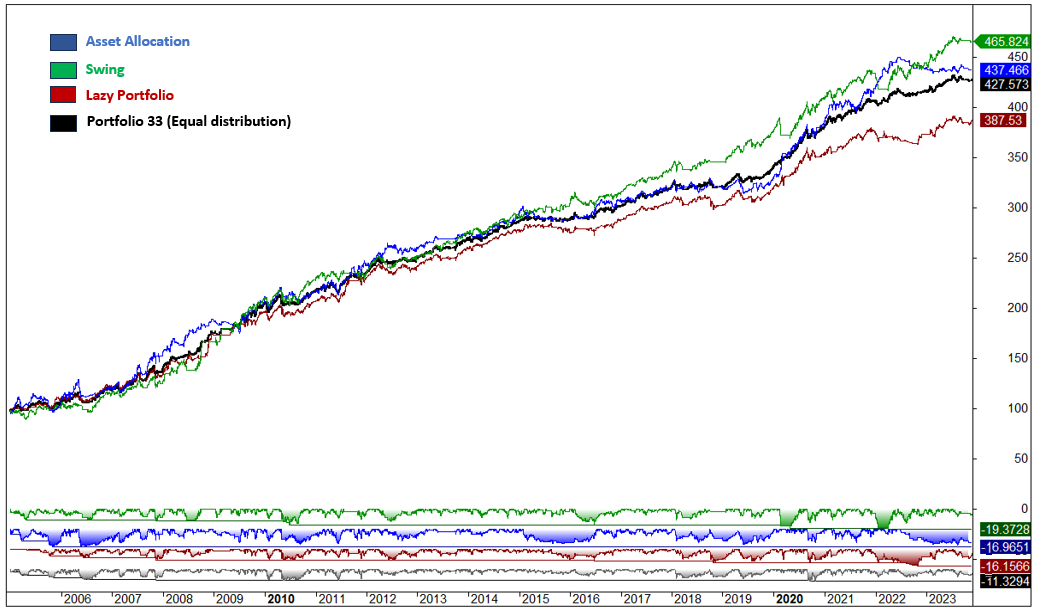

Fig.2 illustrates Cumulative Returns and Draw Down of the three individual Systems and the Portfolio of equal distribution (Portfolio 33):

The results demonstrate that allocating 33% of capital to each strategy in the portfolio significantly improves the drawdown of all the individual strategies without imposing a substantial penalty on the overall return.

Study 2 – Applying Market Filter

For this study, we will use a market filter to divide the market into two risk profiles: active risk (high probability of a bearish market) and non-active risk (high probability of a bullish market). Different filters can be used, such as momentum, moving average of the SPY, VIX levels, VIX moving average, etc. In our case, we utilize a momentum filter based on market breadth data.

After conducting various tests, we are considering two scenarios:

Scenario 1 (Portfolio 33-50):

Deactivating the Asset Allocation system when the risk is active. This is referred to as

Portfolio 33-50 and operates as follows:

- Risk not active: 33% of the capital is assigned to each strategy.

- Risk active: 50% of the capital is allocated to the swing strategy, and the remaining 50% is allocated to the Lazy Portfolio Strategy.

Scenario 2 (Portfolio 50-50):

Deactivating the Asset Allocation system when risk is active and deactivating the Lazy Portfolio when risk is not active. This is referred to as Portfolio 50-50 and operates as follows:

- Risk not active: 50% of the capital is assigned to the swing strategy, and the other 50% is allocated to the Asset Allocation strategy.

- Risk active: 50% of the capital is assigned to the swing strategy, and the remaining 50% is allocated to the Lazy Portfolio Strategy.

Metrics:

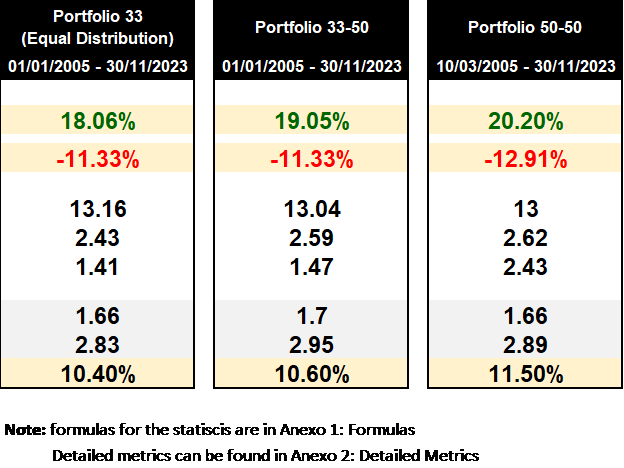

Three portfolios results comparison:

Metrics:

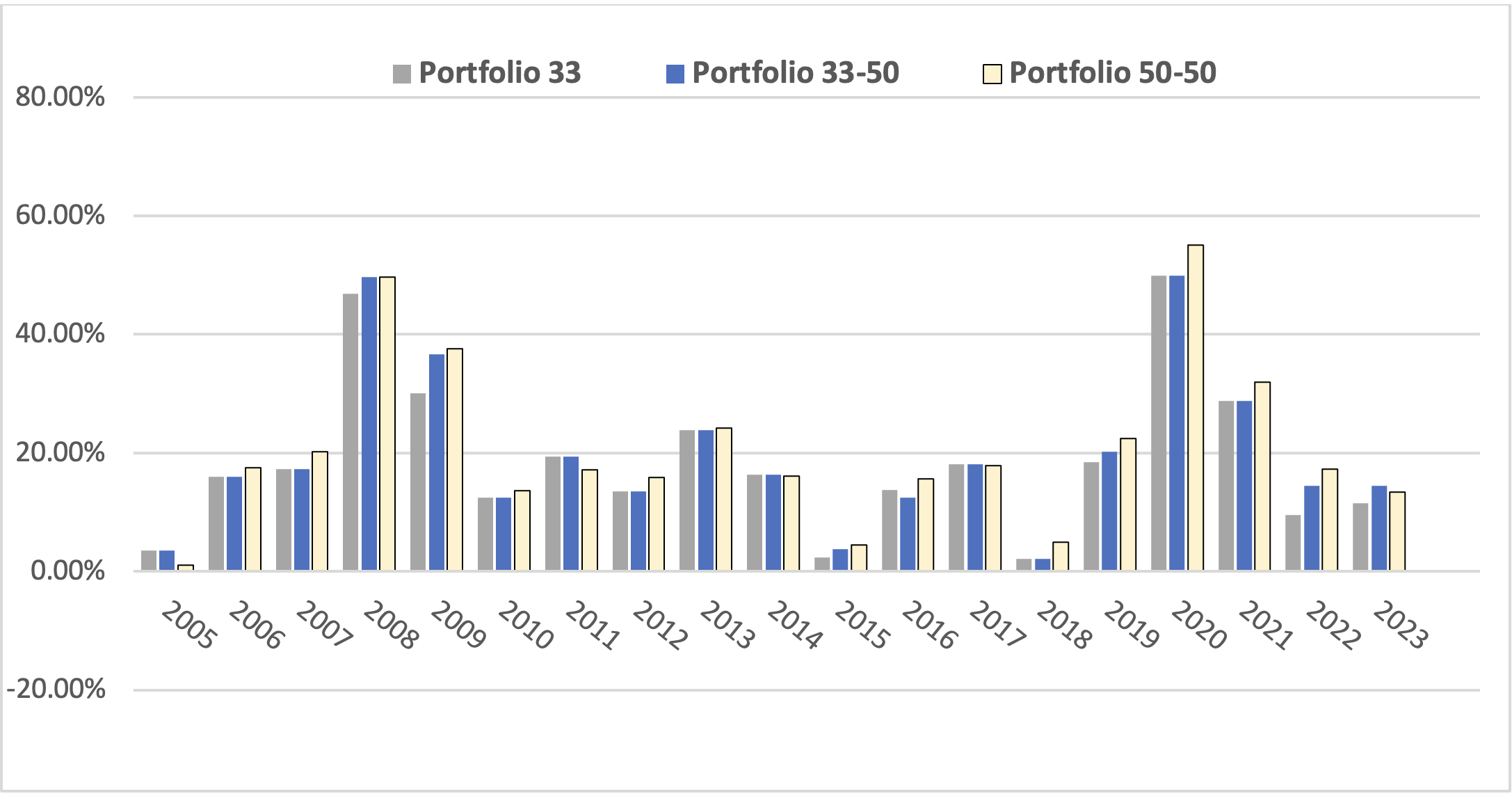

Fig.3 illustrates the Annual Returns for the Three portfolios:

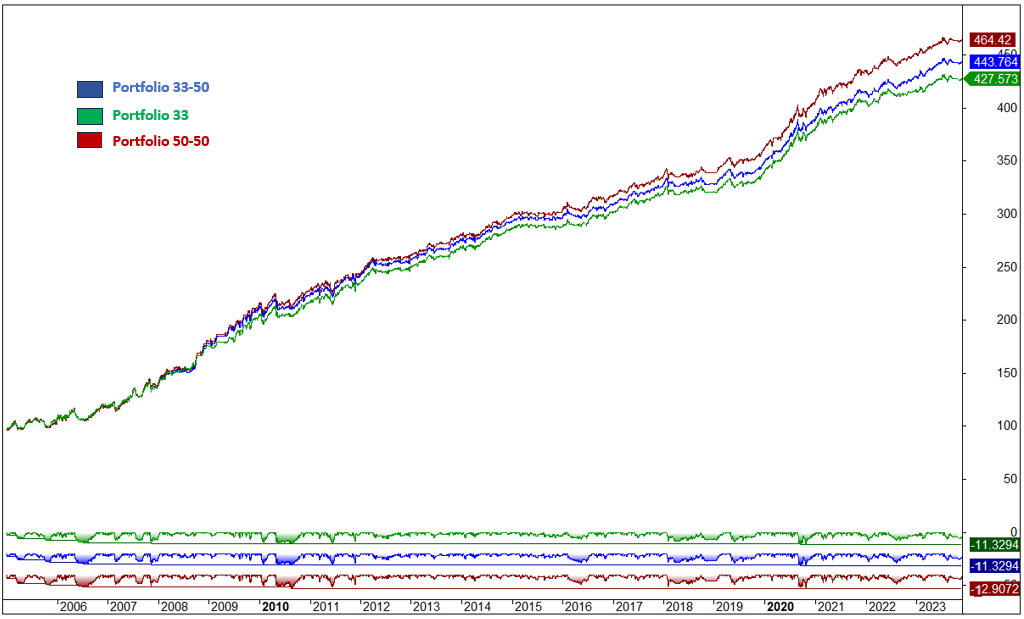

Fig.4 illustrates Profit and Draw Down of the three Portfolios:

Risk vs. Reward

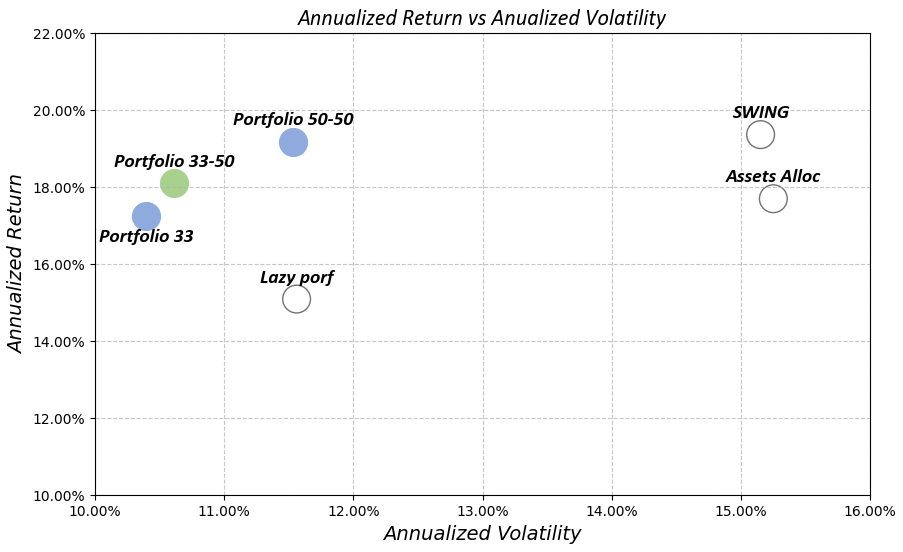

Fig.5 Annualized Return vs Annualized Volatility (Risk-Reward Profiles):

The Risk-Reward diagram illustrates the Risk-Reward profiles for both individual strategies and the three combinations (Portfolios). It highlights that the assumption of higher risks leading to greater rewards cannot be universally applied.

The three Portfolios of strategies show more favourable Risk-Reward profiles, suggesting that employing a combination of Strategies is superior to selecting a singular approach. Despite the higher returns associated with Portfolio 50-50, our inclination is to trade the Portfolio 33-50 for the following reasons:

- Diversification:

The strategy Portfolio 33-50 is more diversified across assets and timeframes, offering a comprehensive approach to risk management. - Risk Mitigation in Bullish Markets:

The exclusion of the Lazy portfolio during potential bullish markets not only increases the risk by almost 1% to achieve a 1% increase in return but also amplifies the Maximum Drawdown by 1.58%. This marginal gain in return does not justify undertaking additional risks.

In conclusion, the analysis supports the notion that optimal Risk-Reward balance is achieved through a strategic combination of systems. The selection of Portfolio 33-50, driven by considerations of diversification and risk-return ratios during bullish markets, aligns with a prudent and nuanced approach to trading.

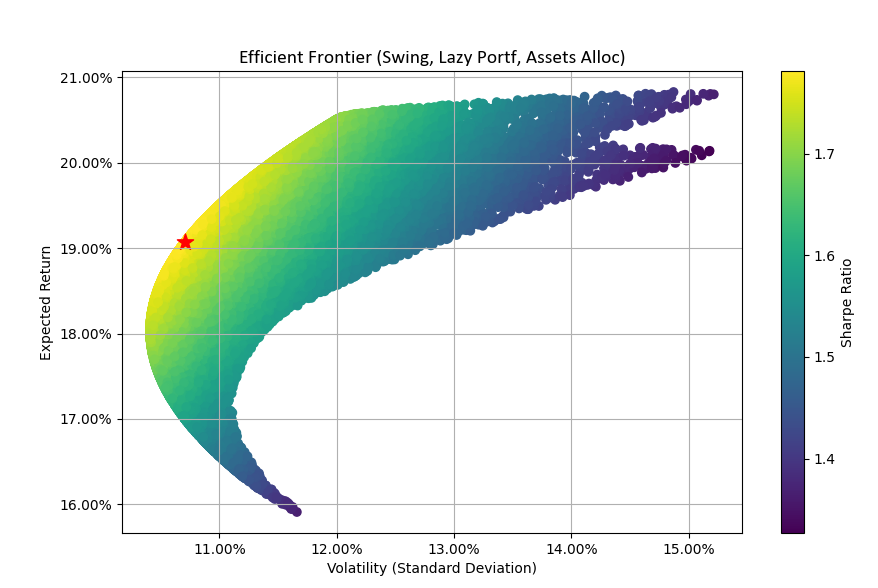

Efficient Frontier and Portfolio 33-50 Analysis

The concept of the 'efficient frontier' presents a powerful tool for portfolio optimization. This section delves into an analytical comparison between the efficient frontier derived from the combination of the three strategies: Swing, Lazy Portfolio, and Assets Allocation. With the performance of the dynamic allocation strategy, Portfolio 33-50.

Understanding the Efficient Frontier

The efficient frontier is a fundamental concept in modern portfolio theory introduced by Harry Markowitz in the 1950s. It represents a set of optimal portfolios that provide the highest expected return for a given level of risk or the lowest risk for a given level of expected return. Portfolios that lie on this frontier are deemed 'efficient' as they optimally balance risk and reward.

On a graph, the efficient frontier is typically plotted with expected return on the y-axis and standard deviation (risk) on the x-axis. Each point on this curve represents a portfolio with a specific combination of assets that maximizes returns for a given risk level.

Analysis of Investment Strategies

The study involves the strategies: Swing, Lazy Portfolio and Assets Allocation. By simulating numerous portfolio combinations with varying allocations to these strategies, we create an efficient frontier. Each point on this frontier signifies a different mix of the three strategies, showcasing the trade-off between risk (volatility) and expected return.

The graph illustrates how varying the allocation between Swing, Lazy Portfolio, and Assets Allocation influences the portfolio's risk and return profile. The point marked by a red star (Optimal Efficient Frontier), representing the portfolio with the highest Sharpe Ratio an indicator of the best risk-adjusted return.

The optimal efficient frontier is composed as follows:

- Swing: 34.40%

- Lazy Portfolio: 34.83%

- Asset Allocation: 30.79%

The key metrics for The Optimal efficient frontier and Portfolio 33-50:

In assessing Portfolio 33-50 against the efficient frontier, it is evident that the strategy closely mirrors the performance of the optimal portfolios. The Portfolio 33-50's higher Sortino Ratio reflects its superior management of downside risk, while its Sharpe Ratio, nearly on par with the frontier's portfolios, confirms similar risk-adjusted returns.

The strategy's effectiveness of the Portfolio 33-50 becomes especially clear during risk-off market phases, where it adeptly diversifies, embodying the efficient frontier's principles. Portfolio 33-50 stands out as a dynamic allocation strategy that not only matches the efficient frontier's benchmarks but also seizes market opportunities to potentially enhance investor outcomes, exemplifying the strategic advantage of adaptable asset allocation within the realm of optimal portfolio construction.

Conclusion

This paper introduces the Quantitative Portfolio Resilient model, a holistic trading approach that synergistically combines Swing Trading, Asset Allocation, and an Enhanced Lazy Portfolio. By integrating these diverse strategies, the model aims for a diversified stance in financial markets, augmented by adaptability through a dynamic market filter.

In our findings, the equal distribution scenario (Portfolio 33) demonstrates its efficacy in mitigating overall maximum drawdown while preserving substantial returns. Moreover, the implementation of the market filter in both Portfolio 33-50 and Portfolio 50-50 configurations exhibits an enhanced risk-adjusted performance, surpassing individual strategy outcomes.

The Risk-Reward analysis underscores the advantage of a multi-strategy portfolio over a singular approach. It challenges the conventional belief that higher risks lead to greater rewards, illustrating the benefits of strategic diversity. Despite Portfolio 50-50's higher returns, our preference for Portfolio 33-50 is grounded in its broader diversification and more favourable risk-return ratios, particularly in bullish market conditions.

Furthermore, our analysis through the lens of the efficient frontier strongly reinforces our preference for Portfolio 33-50. The efficient frontier analysis reveals that Portfolio 33-50 aligns closely with the optimal portfolios, demonstrating a robust balance of risk and return. This portfolio not only adheres to the principles of modern portfolio theory but also exhibits a superior risk-adjusted performance compared to the individual strategies.

Anexo 1: Formulas

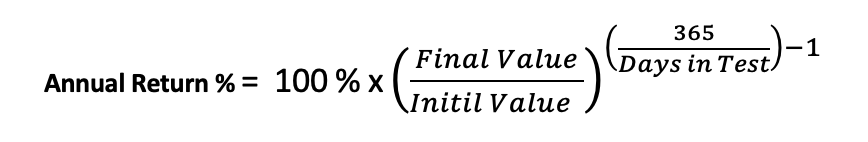

Below are the formulas used to calculate the performance metrics:

Annual Return %: The annualized percentage return is a measure of the average annual rate of return on an investment over a specified time period.

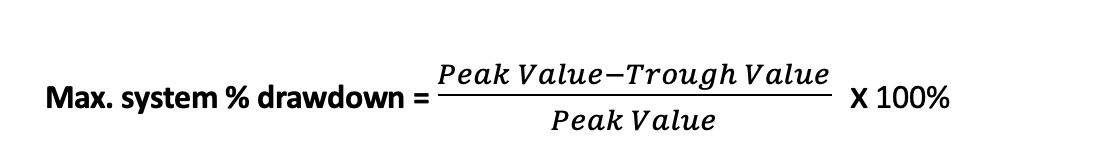

Max. system % drawdown: Maximum percentage decline in the value of a trading system from its highest point (peak) to the lowest subsequent point (trough) over a specified period.

Where:

- Peak Value is the highest point in the value of the trading or investment system.

- Trough Value is the lowest subsequent point in the value of the system.

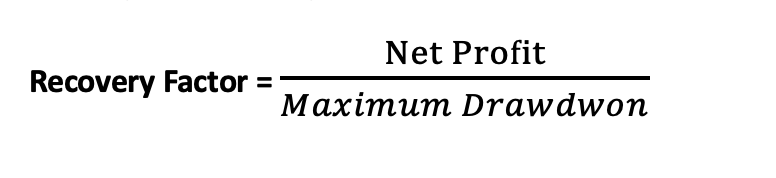

Recovery Factor: Assesses the ability of an investment or trading strategy to recover from losses. It is calculated using the following formula:

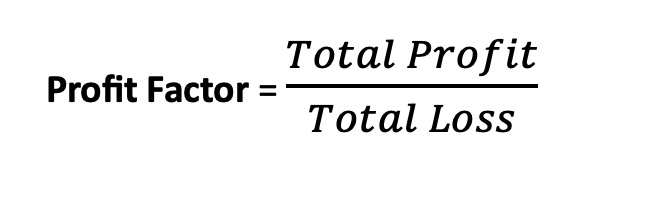

Profit Factor: Measures the profitability of a trading strategy. It is calculated using the following formula:

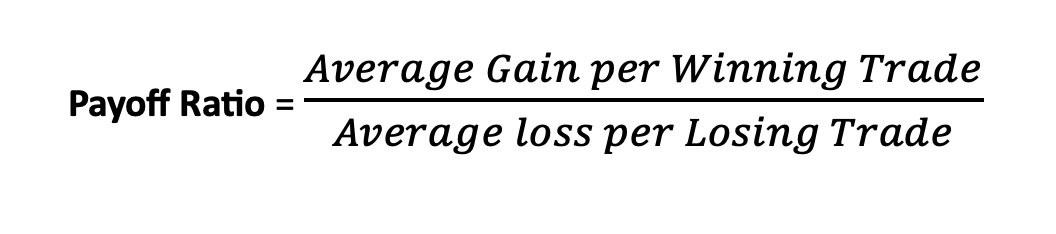

Payoff Ratio: Also known as the risk-reward ratio, is a financial metric used in investing to assess the potential return of an investment relative to the amount of risk undertaken.

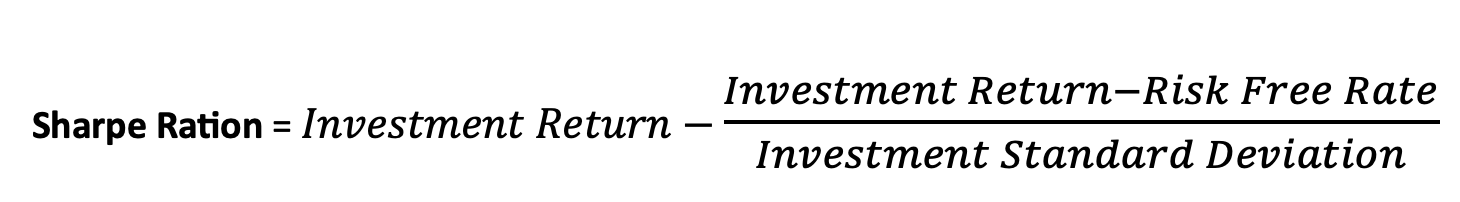

Sharpe Ratio: Is a measure of the risk-adjusted performance of a trading strategy. It helps investors evaluate the return of an investment relative to its risk.

Where:

- Investment Return is the return of the investment or portfolio.

- Risk-Free RateRisk-Free Rate is the return on a risk-free investment.

- Investment Standard Deviation is the standard deviation of the Investment’s returns, which measures the volatility or risk of the portfolio.

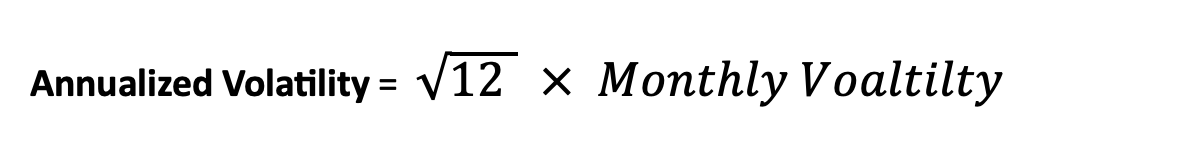

Annualized Volatility: Is a measure of the variability of returns of an investment over a one-year period, expressed as a percentage. It is commonly used in finance to quantify the level of risk or uncertainty associated with an investment.

Calculated using Monthly returns:

Where:

- Monthly Volatility is the standard deviation of monthly returns.

- 12 is the number of months in a year.

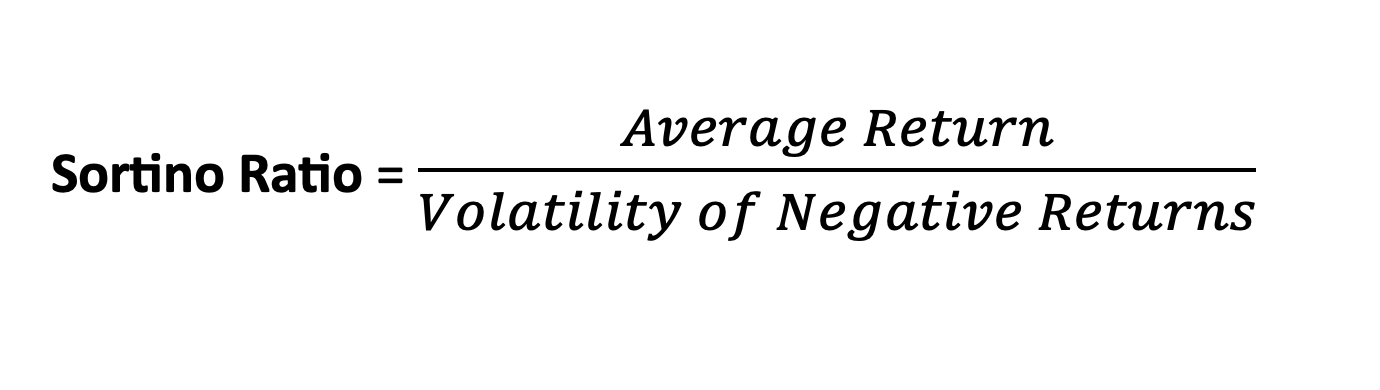

Ratio Sortino: Is a measure of risk-adjusted return that focuses on the downside risk of an investment. It is similar to the Sharpe Ratio, but it considers only the volatility of the downside. while the Sharpe Ratio considers total volatility (both upside and downside), the Sortino Ratio specifically looks at the downside risk, providing a more targeted measure for investors primarily concerned with minimizing losses. The Sortino Ratio can be useful in situations where protecting against downside risk is a critical factor in the investment strategy.

Anexo 2: Detailed Systems metrics

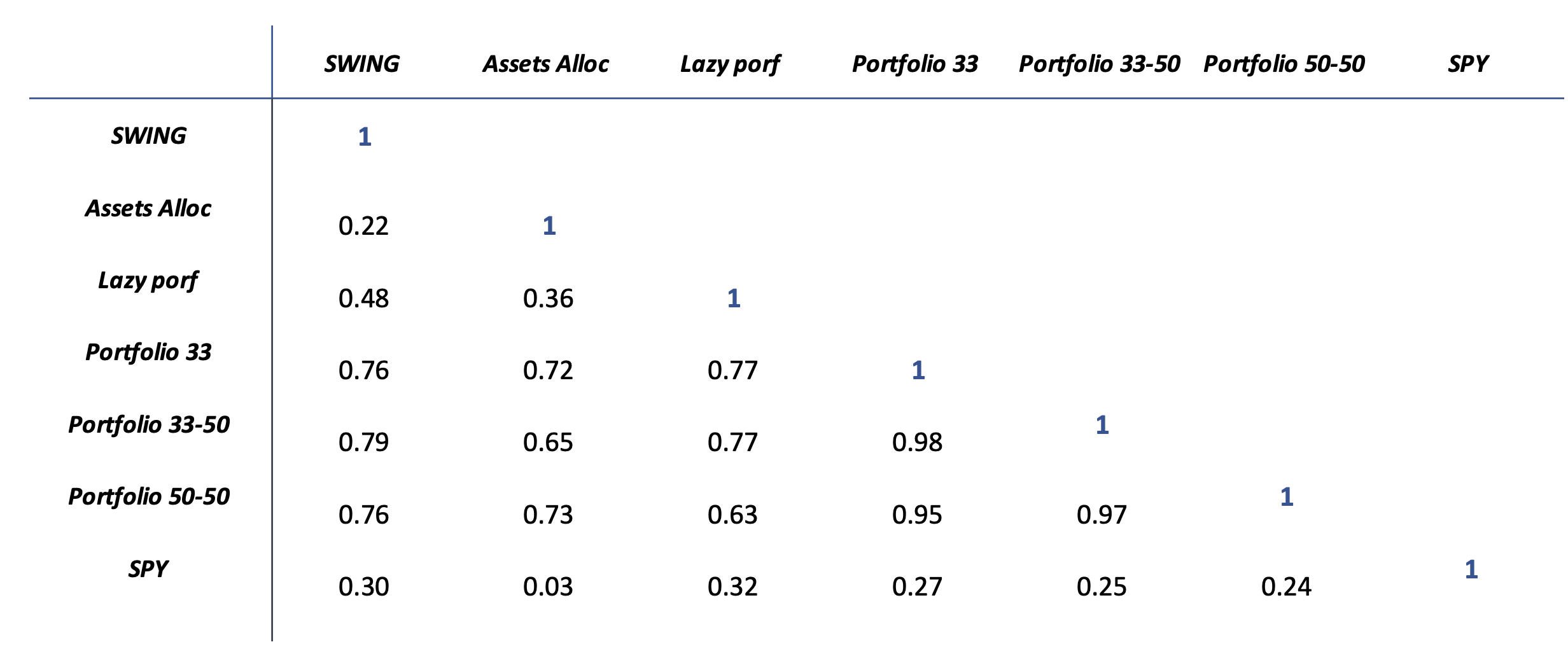

Correlation Matrix: (Data from monthly observations)

Metrics: