Abstract

This paper aims to replicate and advance upon a portfolio optimization strategy presented in a prior study titled (Optimizing Portfolio Performance: A Comprehensive Approach with Swing Trading, Asset Allocation, and Enhanced Lazy Portfolio). Our objective is to replicate this strategy by leveraging UCITS ETFs (Undertakings for Collective Investment in Transferable Securities Exchange-Traded Funds) within the European regulatory framework.

UCITS ETFs adhere to the stringent UCITS directive of the European Union, embodying a harmonized blend of compliance, investor protection, and broad market access across the EU. These meticulously designed funds meet rigorous standards in liquidity, diversification, transparency, and investor safeguarding, offering a regulated avenue for a diverse asset portfolio, including equities, bonds, commodities, and currencies within the European context.

In this study, we not only seek to replicate the strategies outlined in the referenced paper using UCITS ETFs but also to construct and analyze two distinct portfolios. These portfolios allocate varying capital weights to the replicated strategies with the goal of enhancing the overall risk-reward balance. Our primary aim is to mitigate drawdowns without compromising performance. Furthermore, we aspire to identify the Optimal Efficient Frontier portfolio derived from these strategies, providing a comprehensive evaluation of the resulting metrics.

Introduction

Within the European investment landscape, entities such as SICAVs (Société d'Investissement à Capital Variable) and hedge funds have exhibited a notable preference for UCITS funds over their U.S. ETF counterparts. UCITS funds, finely tuned to the specificities of European regulatory requirements, provide a framework that ensures compliance and robust investor protection—essential elements for European financial institutions.

In this research endeavor, we embark on a journey to replicate and enhance the strategies delineated in the previously mentioned paper, deploying UCITS ETFs. Our primary focus is on the Swing and Lazy Portfolio strategies, as the extensive ETF range required for Asset Allocation is incompatible with the UCITS framework. Additionally, our analysis is confined to the period from January 1, 2009, to December 8, 2023, due to the unavailability of comprehensive UCITS ETF data prior to January 2009.

Our overarching goal is to optimize portfolio performance during this period, striving to minimize volatility without significantly impacting returns. The following sections will delve deeper into the results of our analysis, including key metrics and insights into portfolio optimization using UCITS ETFs.

Study Limitations

This study is subject to specific limitations:

- Adaptability to UCITS for U.S. ETF Strategies: While the original portfolio employed Swing Trading, Asset Allocation, and Lazy Portfolio strategies, the extensive ETF range required for Asset Allocation is not compatible with the UCITS framework. Hence, this study is focused on adapting and analyzing the Swing and Lazy Portfolio strategies within UCITS constraints.

- Data Availability Constraints: Our analysis is limited to the period from January 2009 to December 2023. This limitation is due to the unavailability of comprehensive UCITS ETF data prior to January 2009, necessary for accurately replicating the original strategies.

The research, therefore, utilizes UCITS ETFs to implement the Swing and Lazy Portfolio strategies from January 1, 2009, to December 8, 2023, aiming to optimize portfolio performance by minimizing volatility without significantly impacting returns.

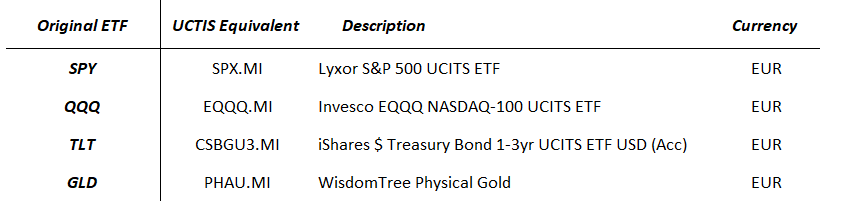

The mapping of original ETFs to UCITS equivalents is as follows:

Strategies UCITs

In this paper, we detail the adaptation of the original algorithm to align with UCITs-compliant ETFs. The backtesting of these strategies and the portfolios, which will be discussed later in this paper, was conducted over a specified period using Amibroker, a sophisticated analytical tool. This paper includes a series of figures that display the outcomes of these backtests. Additionally, a Python script was developed to generate metrics that are not available in Amibroker.

Swing:

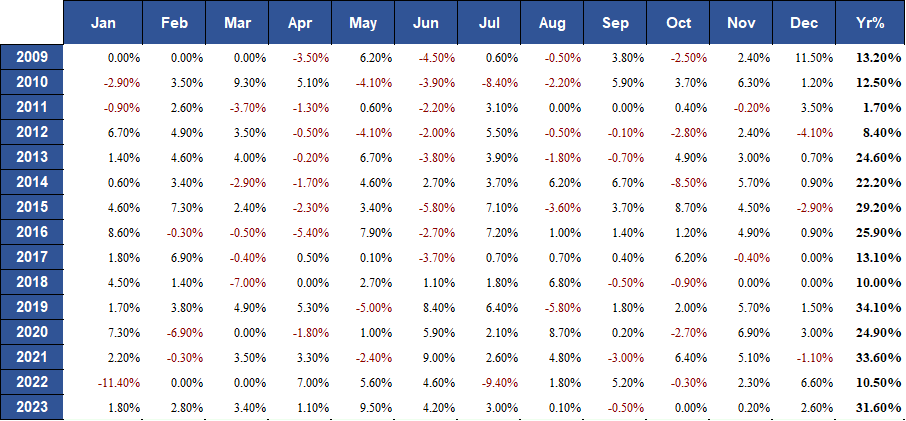

The Swing strategy, when implemented with UCITS ETFs, exhibited a consistently positive annual performance, surpassing the benchmark S&P 500. This achievement was realized while maintaining a controlled level of drawdown, a detail that will be further elucidated in the upcoming figure highlighting key metrics. Importantly, though the performance of this strategy, when compared to its implementation with USA ETFs, is marginally lower, it is notable that both strategies demonstrate similar drawdown levels. Moreover, the UCITS ETFs version of the strategy exhibited lower volatility, underscoring the comparable risk-reward profile of both approaches.

Fig.1: Swing UCITS monthly and annual returns

The following illustration presents key metrics for the Swing strategy when implemented with UCITS ETFs and for the Swing strategy using USA ETFs, with SPY serving as a benchmark for comparison. For detailed information on the calculation methods of these metrics, please refer to Annex I.

Fig. 2: Key Metrics Comparison - Swing UCITS Strategy vs. Swing USA Strategy and SPY (Benchmark)

Fig. 3: Cumulative Returns and Drawdown Comparison - Swing UCITs Strategy vs. Swing USA Strategy and SPY (Benchmark)

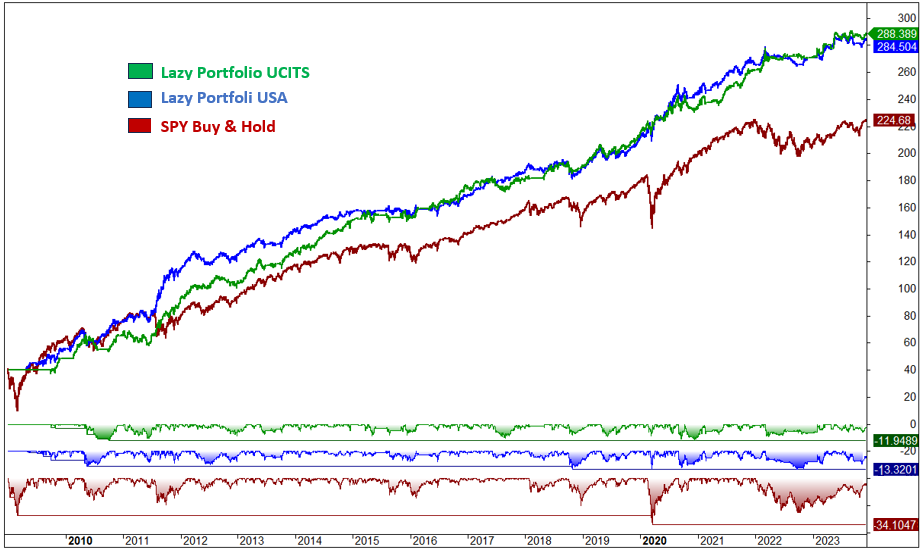

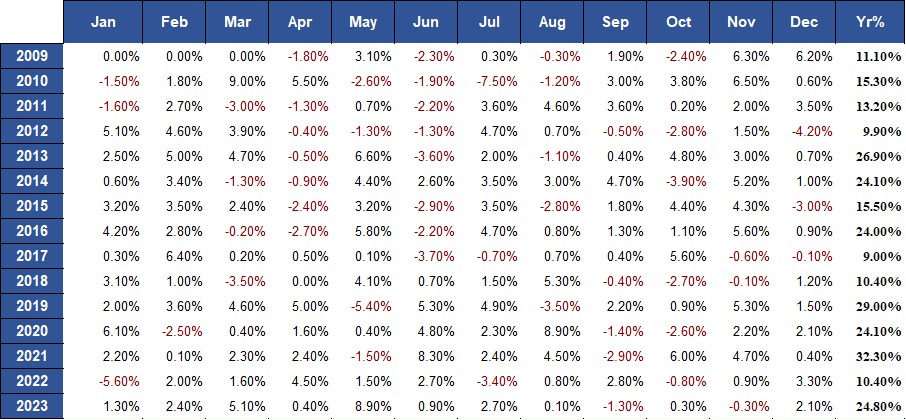

Lazy Portfolio:

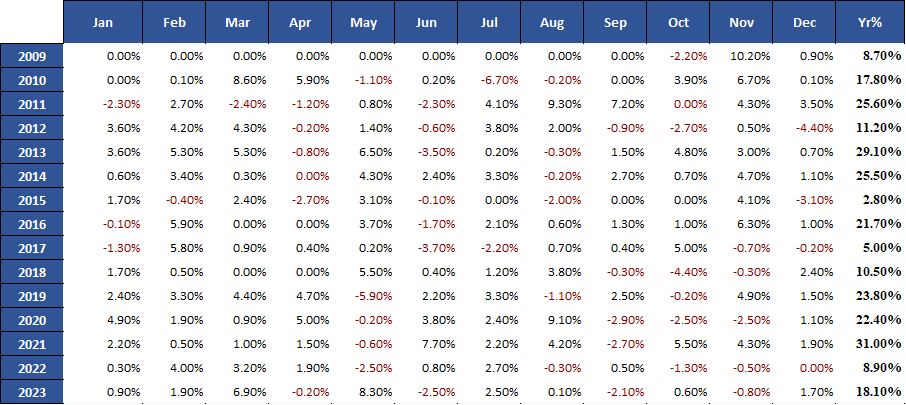

The Lazy Portfolio strategy, using UCITS ETFs, outperformed both its USA ETFs counterpart and the S&P 500 benchmark in annual returns. This strategy achieved higher returns with lower drawdown and volatility, aspects detailed in the upcoming figure. Compared to the USA ETFs version, the UCITS ETFs implementation of the Lazy Portfolio maintained controlled drawdown levels and exhibited significantly reduced volatility, underlining its superior risk-reward profile.

Fig.4 Lazy Portfolio UCITS monthly and annual returns

The following illustration presents key metrics for the Lazy Portfolio strategy.

Fig. 5: Key Metrics Comparison – Lazy Port UCITS Strategy vs. Lazy Port USA Strategy and SPY (Benchmark)

Fig.6: Cumulative Returns and Drawdown Comparison – Lazy P. UCITs Strategy vs. Lazy P. USA Strategy and SPY (Benchmark)

In summary, our examination of the Swing and Lazy Portfolio strategies using UCITs ETFs reveals a commendable performance profile. Both strategies not only outperformed the SP500 benchmark in terms of returns but also managed drawdown effectively. The Swing strategy, in particular, demonstrated a performance with UCITs ETFs that closely mirrors its results with U.S. ETFs, highlighting its versatility and efficiency within Europe’s regulatory environment. Furthermore, the Lazy Portfolio strategy, when applied with UCITs ETFs, notably surpassed its U.S. ETFs counterpart in both returns and risk management, showcasing lower drawdown and volatility. This underlines the potential advantages of employing UCITs ETFs for sophisticated portfolio management in European markets.

In subsequent sections, our paper will explore portfolios combining these strategies in varying allocations, specifically focusing on the (50-50) and (70-30) mixes. Additionally, We aim to identify the most efficient portfolio mix on the Efficient Frontier and to compare the risk-reward profiles of the combined strategies. This comprehensive analysis is intended to provide deeper insights into the interplay between the strategies and their collective capacity to optimize risk-adjusted returns in diverse portfolio compositions.

Portfolios 50-50 and 70-30

This section focuses on analyzing two distinct portfolios, each with a unique combination of strategies:

- Portfolio 50-50, evenly split with 50% Swing strategy and 50% Lazy Portfolio.

- Portfolio 70-30: comprising 70% Swing strategy and 30% Lazy Portfolio.

Our methodology involved using Amibroker to harness equity data from both strategies. We implemented the specified allocations and conducted monthly rebalancing to accurately mimic the strategies' real-world performance, particularly addressing the Lazy Portfolio's rebalancing needs. To address any gaps in Amibroker's output, we supplemented our analysis with custom Python scripts, allowing for a more comprehensive metric assessment.

The results:

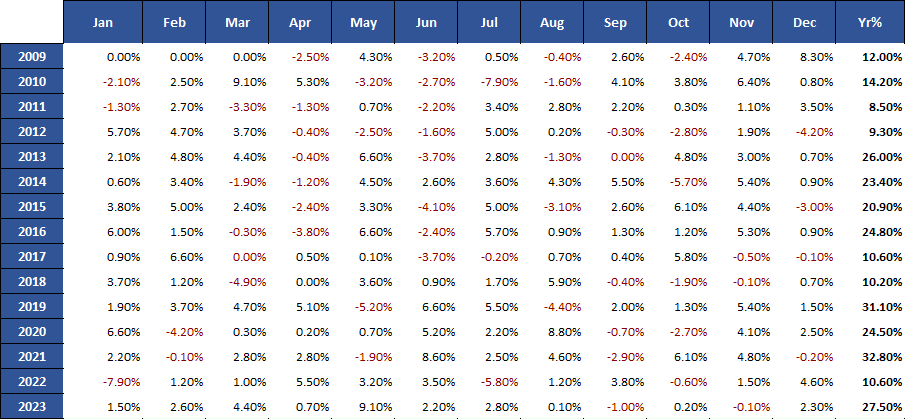

Portfolio 50-50:

The figures to follow show that Portfolio 50-50 effectively lowers drawdown compared to the Swing strategy, without sacrificing returns. It also slightly improves upon the Lazy Portfolio's performance, though it incurs a modestly higher drawdown, about 3% more, yet within a tolerable range. The portfolio maintains low volatility, similar to that of the Lazy Portfolio. Its risk-reward ratio is acceptable, striking a balance between low risk and solid performance. A detailed presentation of these metrics will be featured in the upcoming figure.

Fig. 7: Portfolio 50-50 Monthly and Annual Returns

Portfolio 70-30:

Portfolio 70-30 exhibits a higher drawdown compared to Portfolio 50-50, despite having nearly identical annualized returns. Although its increased volatility remains within acceptable limits, it doesn't offer a significant advantage over the more balanced Portfolio 50-50. While Portfolio 70-30 enjoys a slight edge in returns, its higher risk and volatility make it a less attractive choice. Detailed information on the risk-reward ratio for Portfolio 70-30 will be provided in an upcoming figure, highlighting key metrics.

Fig. 8: Portfolio 70-30 Monthly and Annual Returns

Fig. 9: Comparison of Key Metrics - Portfolio 50-50 and Portfolio 70-30 vs. SPY (Benchmark)

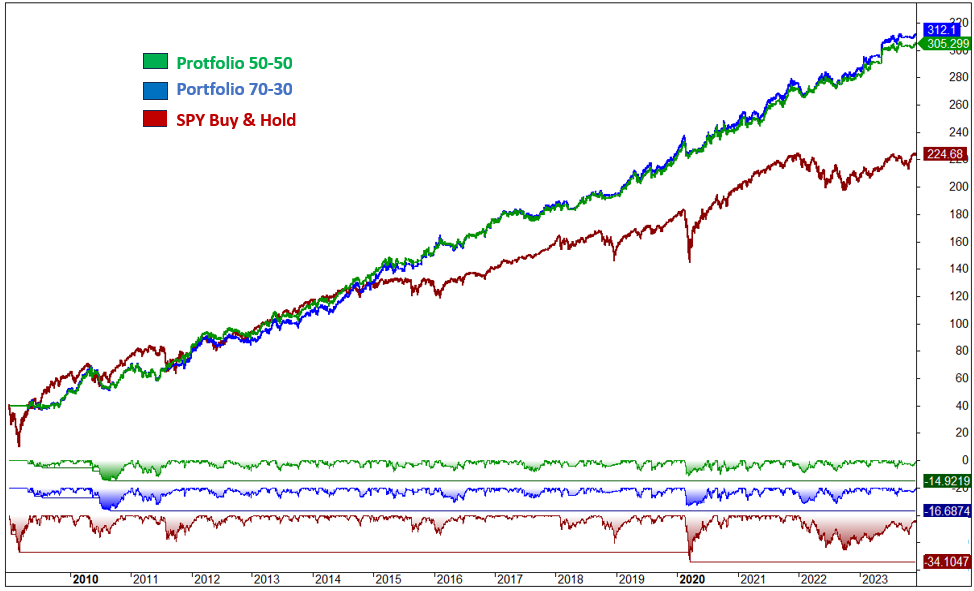

Fig. 10: Comparison of Cumulative Returns and Drawdown - Portfolio 50-50 and Portfolio 70-30 vs SPY (Benchmark)

In conclusion, our detailed examination of Portfolio 50-50 and Portfolio 70-30 offers key insights into the nuanced risk and performance profiles of these combined strategies.

Portfolio 50-50, balancing the Swing and Lazy Portfolio strategies equally, successfully reduces drawdown relative to the Swing strategy, while still achieving comparable returns. It marginally improves upon the performance of the Lazy Portfolio, albeit with a slightly higher drawdown, about 3% more but acceptable. Notably, its volatility is low and comparable to the Lazy Portfolio, presenting a well-rounded risk-reward profile.

Portfolio 70-30, with a greater emphasis on the Swing strategy, exhibits a higher drawdown and increased volatility compared to Portfolio 50-50, without significantly enhancing annual returns. This makes Portfolio 70-30 a less attractive option in terms of risk-reward balance, especially when the additional risk does not correspond with a proportional increase in returns.

Each portfolio presents distinct characteristics, with Portfolio 50-50 standing out for its balanced approach. The next section of our study will delve into identifying the optimal Efficient Frontier portfolio composition, further exploring how these combined strategies can be optimized within the UCITS ETF framework. This will include a comprehensive assessment of metrics and risk-reward profiles for each strategy and their combined portfolio forms.

Optimal Efficient Frontier:

In this section of our study, we aim to construct a portfolio that achieves the optimal distribution of strategies by applying the principles of the Optimal Efficient Frontier.

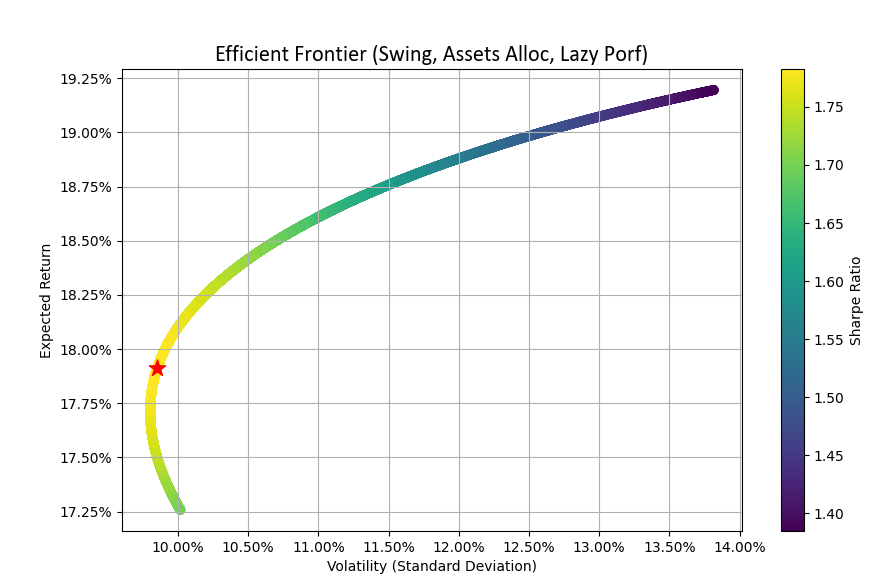

The Optimal Efficient Frontier, a fundamental concept in modern portfolio theory developed by Harry Markowitz, illustrates the trade-off between portfolio risk and return, with the goal of maximizing the Sharpe ratio. It identifies efficient portfolios that either maximize expected return for a given risk or minimize risk for a set return, with a focus on maximizing the Sharpe ratio, a metric of risk-adjusted return. Portfolios positioned on this curve represent optimal efficiency, providing the highest possible return for a given level of risk, in line with the objectives of investors. This involves analyzing assets' expected returns, variances, and covariances to construct portfolios that enhance the Sharpe ratio.

To compute the optimal frontier, we employed monthly returns data for the strategies and generated the calculations and accompanying graph using a Python script.

The following graph represents the Efficient Frontier simulations. The point marked with a red star (Tangency Portfolio) indicates the optimal portfolio on the Efficient Frontier, comprising a combination of the Swing and Lazy Portfolio strategies that achieves the highest Sharpe ratio.

Fig. 11: Efficient Frontier Simulation

As highlighted by the red star in the above graph, the composition of the Optimal Efficient Frontier portfolio is as follows:

- Swing: 26%

- Lazy Portfolio: 74%

This optimal frontier portfolio is based on the entire dataset provided, spanning from 2009 to 2023. It is advisable to periodically recalculate the Optimal Efficient Frontier and adjust the portfolio weights accordingly. The frequency of these recalculations and adjustments should be based on various factors, including prevailing market conditions, the chosen investment strategy, and the investor's risk tolerance and investment horizon.

General recommendations for recalibration are as follows:

Active Management Approach: For those adopting an active management style, a review every quarter or semi-annually is typically recommended.

Passive Management Approach: For investors with a more passive strategy, an annual review is generally sufficient.

Ultimately, the decision to rebalance should be in line with the overarching investment strategy, carefully weighing the costs and benefits. Consulting with a financial advisor can be advantageous to customize the approach to suit individual needs and adapt to changing market conditions.

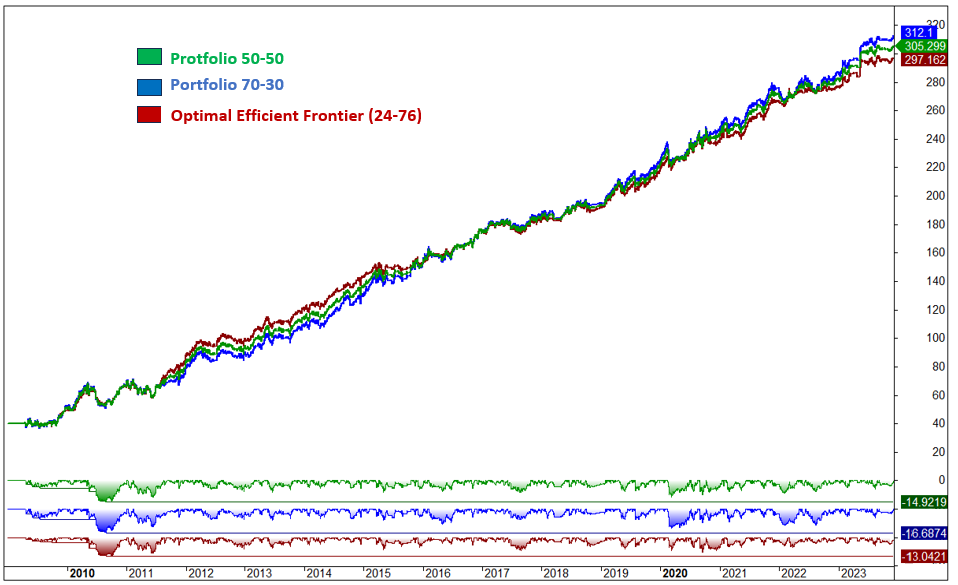

Fig. 12: Comparison of Cumulative Returns and Drawdown - Portfolio 50-50 and Portfolio 70-30 vs Optimal Portfolio

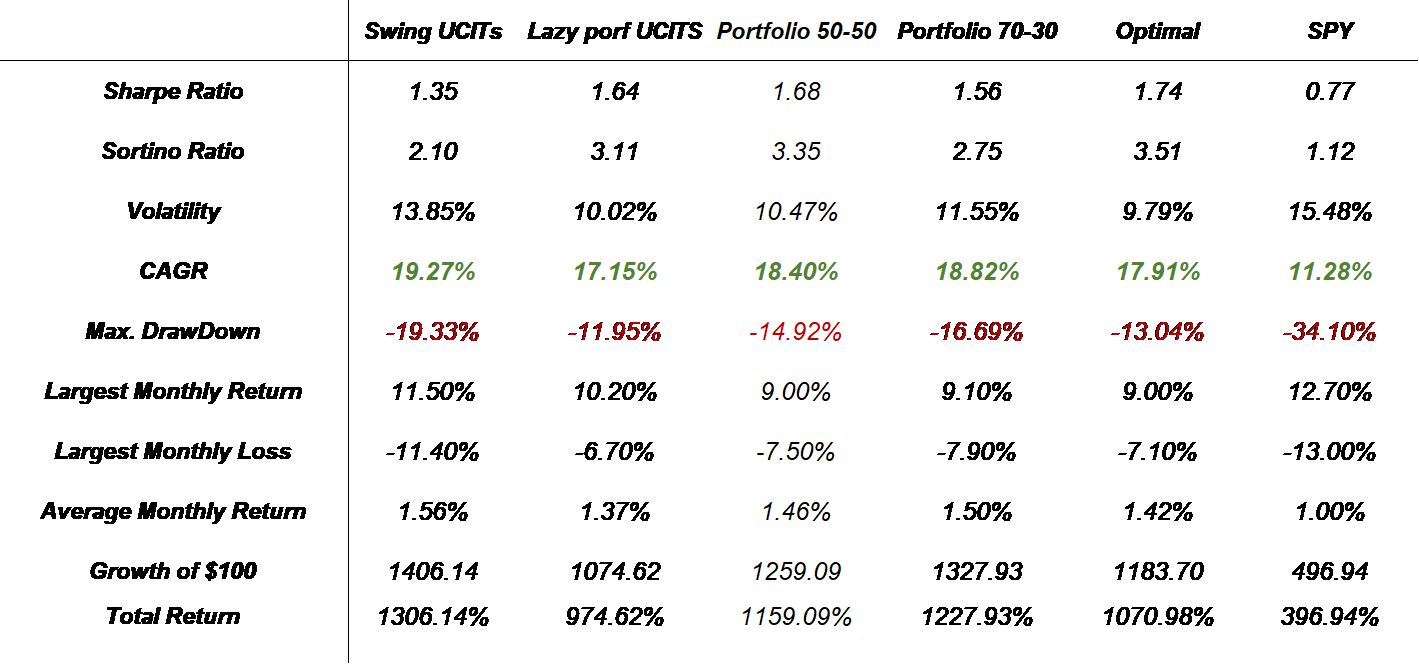

Metrics

Below are the metrics for all the portfolios and the strategies.

Risk-Reward Analysis:

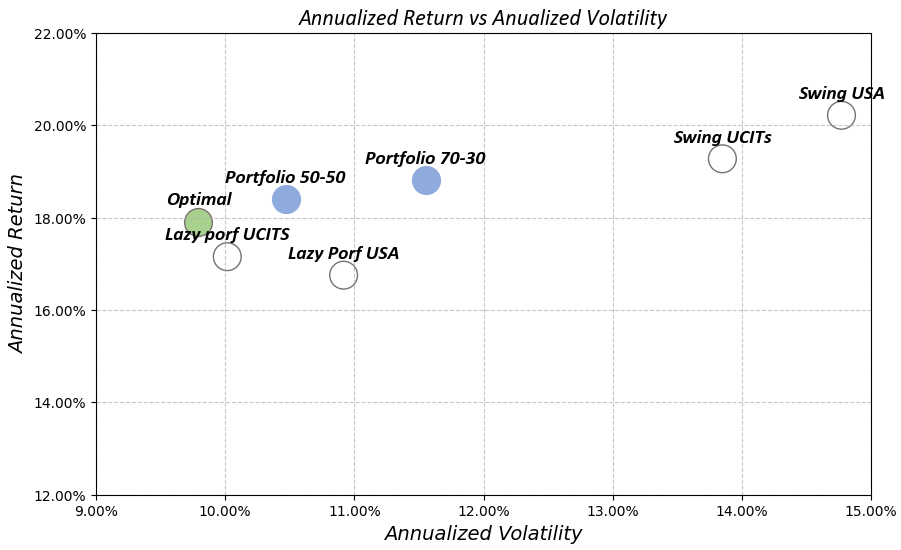

The graph presented below provides a comprehensive representation of various strategies and portfolios, plotted based on their risk-reward profiles. On this graph, the x-axis denotes Volatility, serving as a measure of risk, while the y-axis represents the Expected Returns, indicating the potential reward. This analytical tool compares all the strategies based on their respective positions in terms of risk and return, offering a clear visual depiction of the trade-offs involved.

Each point on the graph corresponds to a specific strategy or portfolio, with its position reflecting the inherent balance between the expected return and the associated level of volatility. Portfolios or strategies that appear higher on the y-axis suggest higher expected returns, whereas their positioning along the x-axis indicates the level of risk, measured in terms of volatility, that investors would undertake.

This risk-reward graph is instrumental in providing investors with crucial insights into the performance dynamics of each strategy. It aids in making informed decisions by illustrating how different portfolios compare in terms of their potential returns for a given level of risk. Such a visual comparison is invaluable for strategic portfolio planning, helping investors to align their choices with their individual risk tolerance and return objectives.

Fig.12: Risk-Reward Analysis of Strategies and Portfolios

This section's analysis of UCITS and USA ETFs within the Swing and Lazy Portfolio strategies elucidates distinct performance attributes. Notably, the Lazy Port UCITS delivers superior returns compared to its USA counterpart, challenging prevailing market expectations, and suggesting unique benefits inherent to UCITS ETFs that merit further exploration.

The Swing strategies conform to expected risk-return paradigms, with the Swing USA's higher returns corresponding to increased volatility, affirming its high-risk, high-reward profile. Alternatively, the Swing UCITS showcases a conservative stance, offering lower returns for decreased risk.

The comparison of the Portfolio 70-30 with the Portfolio 50-50 reveals that higher risk does not necessarily translate into proportionally higher returns, highlighting the significance of precise weight allocation in portfolio construction. This observation validates the utility of the optimal frontier in identifying efficient asset combinations, thereby optimizing the risk-return equation.

The 'Optimal' portfolio, closely aligned with the efficient frontier derived from UCITS strategies, represents a model of investment efficacy, potentially offering the most beneficial risk-return trade-off and demonstrating the practical application of modern portfolio theory principles.

These insights stress the imperative of strategic weight management in portfolio optimization and serve as a catalyst for further academic discourse on ETF performance drivers in diverse markets.

Conclusion

This study has successfully replicated and advanced upon a portfolio optimization strategy within the European context using UCITS ETFs. Our findings demonstrate that these strategies, when adapted to comply with the UCITS regulatory framework, not only conform to risk-return expectations but also reveal unique performance characteristics that contribute to portfolio efficiency.

The Lazy Port UCITS strategy, in particular, has shown an ability to surpass its USA counterpart in terms of returns, without incurring additional risk. This unexpected result underscores the potential benefits of UCITS ETFs, which extend beyond compliance to offer compelling investment opportunities.

While the Swing strategy implemented with UCITS ETFs mirrors the performance of its USA ETFs equivalent, it has done so with reduced volatility, showcasing the robustness of this strategy within the stringent UCITS framework and its suitability for investors seeking to maintain a controlled risk profile.

The analysis of the 50-50 and 70-30 portfolios has further elucidated the critical role of weight allocation in achieving an optimal risk-reward balance. It becomes clear that higher risk does not always equate to higher returns, emphasizing the importance of strategic allocation in line with the principles of the Optimal Efficient Frontier.

The portfolio identified as 'Optimal' demonstrates the practical application of modern portfolio theory, capturing the most favorable balance between risk and returns. This portfolio, poised on the efficient frontier, illustrates the value of meticulous strategic planning and the advantages of UCITS ETFs in optimizing risk-adjusted returns.

In sum, our research contributes to the academic dialogue on portfolio optimization, highlighting the efficacy of UCITS ETFs in a regulated European investment landscape. It provides a foundation for future inquiry into the nuanced mechanisms of ETF performance and offers a robust framework for investors seeking optimized portfolio solutions in European markets.

Anexo 1: Formulas

Below are the formulas used to calculate the performance metrics:

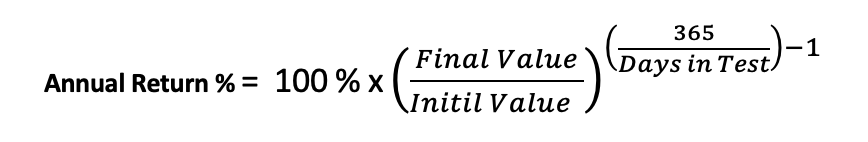

Annual Return %: The annualized percentage return is a measure of the average annual rate of return on an investment over a specified time period.

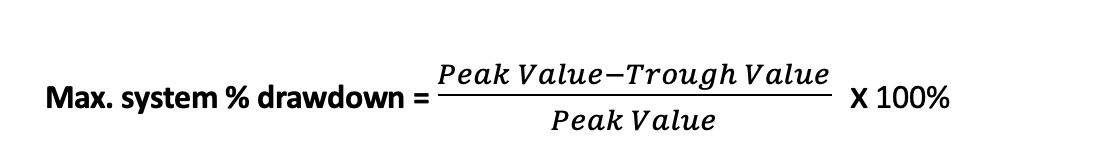

Max. system % drawdown: Maximum percentage decline in the value of a trading system from its highest point (peak) to the lowest subsequent point (trough) over a specified period.

Where:

- Peak Value is the highest point in the value of the trading or investment system.

- Trough Value is the lowest subsequent point in the value of the system.

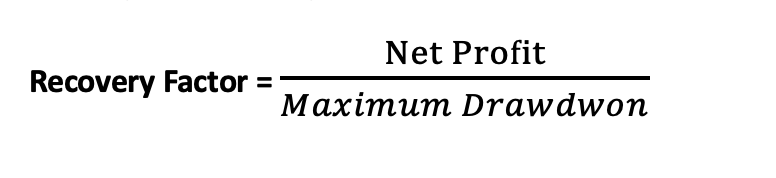

Recovery Factor: Assesses the ability of an investment or trading strategy to recover from losses. It is calculated using the following formula:

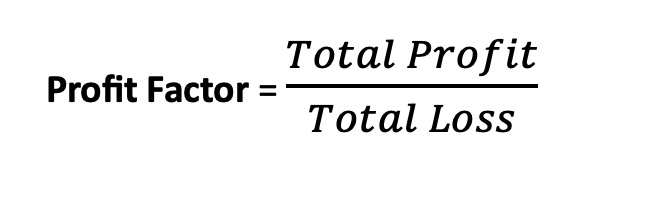

Profit Factor: Measures the profitability of a trading strategy. It is calculated using the following formula:

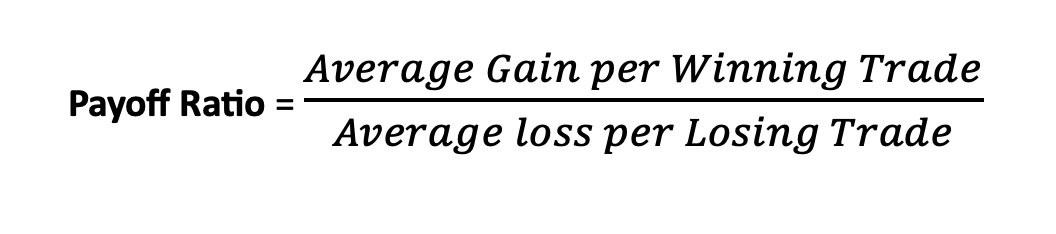

Payoff Ratio: Also known as the risk-reward ratio, is a financial metric used in investing to assess the potential return of an investment relative to the amount of risk undertaken.

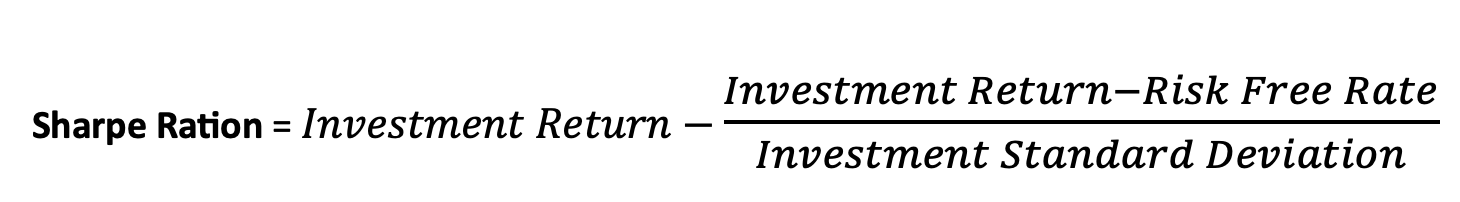

Sharpe Ratio: Is a measure of the risk-adjusted performance of a trading strategy. It helps investors evaluate the return of an investment relative to its risk.

Where:

- Investment Return is the return of the investment or portfolio.

- Risk-Free RateRisk-Free Rate is the return on a risk-free investment.

- Investment Standard Deviation is the standard deviation of the Investment’s returns, which measures the volatility or risk of the portfolio.

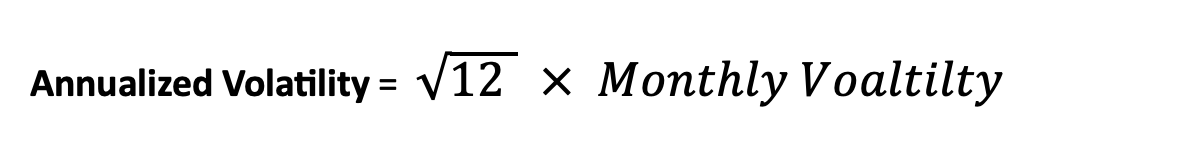

Annualized Volatility: Is a measure of the variability of returns of an investment over a one-year period, expressed as a percentage. It is commonly used in finance to quantify the level of risk or uncertainty associated with an investment.

Calculated using Monthly returns:

Where:

- Monthly Volatility is the standard deviation of monthly returns.

- 12 is the number of months in a year.

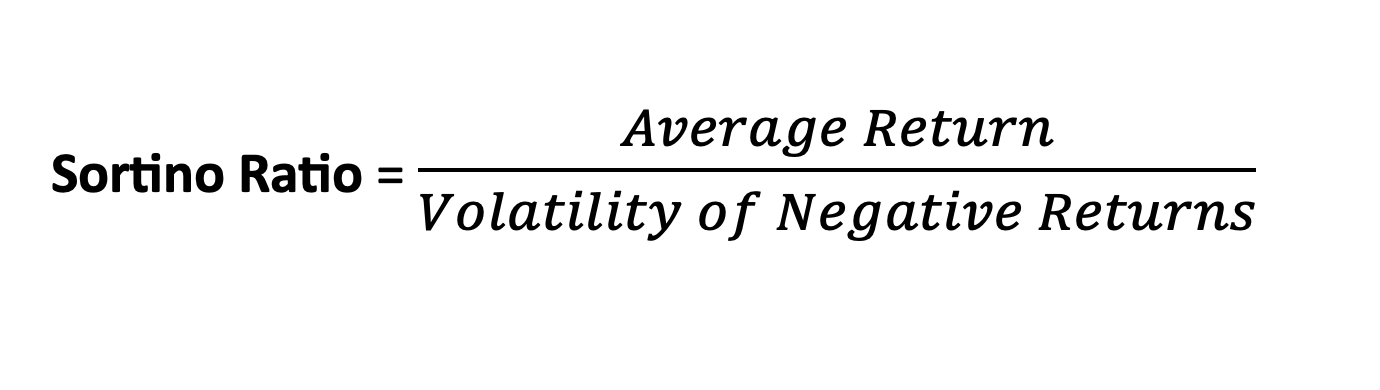

Ratio Sortino: Is a measure of risk-adjusted return that focuses on the downside risk of an investment. It is similar to the Sharpe Ratio, but it considers only the volatility of the downside. while the Sharpe Ratio considers total volatility (both upside and downside), the Sortino Ratio specifically looks at the downside risk, providing a more targeted measure for investors primarily concerned with minimizing losses. The Sortino Ratio can be useful in situations where protecting against downside risk is a critical factor in the investment strategy.