What can you expect?

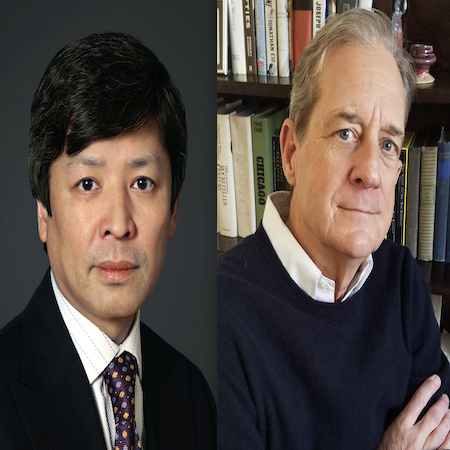

In this episode, CARL’s Jamie Uppenberg speaks with George Egan and Masao Matsuda, investment managers for the Fuji strategy now available on the CARL app.

Fuji is an outcome-oriented investment fund. Copernicus Investment and Risk Advisors uses the proprietary Dynamic Factor Portfolio (DFP) strategy developed by Masao Matsuda, PhD and FRM as a result of his decades of research as a Financial Risk Manager (FRM) at Nikko Securities and beyond. The strategy is predictive of equity market volatility, which is used as a basis to build a portfolio of quant index strategies used by institutional investors that meet a targeted risk (loss of money) levels and achieve the highest risk adjusted returns under certain equity volatility conditions. Importantly, the strategy uses only a fraction of the Fund assets to effect the proper exposure, allowing us to allocate the majority of cash to other assets. For Fuji we have identified two yield bearing, negatively correlated to DFP REITS to substantially increase returns while providing current income and further reducing risk to the portfolio.

More info about Fuji: Fuji

Episode Highlights

- 0:00 - Intro

- 2:11 - Overview of the strategy and what has made it so successful

- 6:02 - Making sophisticated investments more accessible

- 7:46 - What makes the Fuji strategy successful

- 12:32 - Risk management

- 21:27 - Putting your money to work

- 24:29 - Understanding Fuji as an investor

- 26:25 - Final thoughts

Our Guest

Masao Matsuda and George Egan

Copernicus Investment and Risk Advisors was co-founded by Masao Matsuda, PhD., FRM and George Egan, CAIA.Copernicus Investment and Risk Advisors was co-founded by Masao Matsuda, PhD., FRM and George Egan, CAIA.

Dr. Masao earned a Ph.D. degree in International Political Economy from The Claremont Graduate University in California. Masao also holds professional designations as a Financial Risk Manager (FRM), as well as a Chartered Alternative Investment Analyst (CAIA). Masao worked as head of various US entities of Nikko Securities Co., Ltd. Masao also served as Global Head and CIO of the World Series business of Nikko Asset Management (Nikko AM), a division that generated the largest amount of revenues for Nikko AM at that time. Masao has extensive experience in developing quantitative models for asset allocation and has worked with many well-known academics including William F. Sharpe, a 1990 Nobel Laureate in Economic Sciences. Masao has been active in both professional communities and has contributed a number of articles in Alternative Investment Analyst Review, as well as in All About Alpha, both published by the CAIA Association. For the past 13 years, created test items for FRM examinations, and acted as a formal reviewer of 8 chapters of the FRM’s 2020 textbooks in "Financial Markets and Products" and "Valuation and Risk Models."

George Egan graduated with a B.S. degree from Georgetown University and for over 20 years worked on and managed trading desks for banks including Morgan Stanley and later managed a hedge fund at Morgan Stanley. George was CIO at Spencer Trask and Chief Investment Strategist for the $1 billion Illinois 529 plan. George also operated a Fund of Funds allocating among a group of hedge Funds.

OUR HOST

Jamie Uppenberg

Jamie has 15+ years in digital payments, banking and financial services software development. She’s held several executive management positions in digital product software delivery, working various digital payment projects with big tech such as Apple and Google. Jamie brings extensive compliance, regulatory and KYC product and process management.

Latest Episodes

The "Invest with CARL" podcast is a bite-sized treasure trove for anyone looking to brush up on the basics or learn the latest hedge fund news. If you're just learning how to invest, the CARL podcast offers you plenty of information for beginners, concise enough to listen to on your commute.

Sophisticated Alternative Investments Aren’t Just for Institutions Anymore

LEARNING CENTER

Want to learn more about alternative investing with hedge funds?

The world of finance is open to anyone willing to educate themselves. You don't necessarily need a financial advisor to make sound decisions. As experts that handle alternative investments with quant hedge funds at CARL, we know our way around town and love to share our knowledge. Dive into our various information resources to become a self-made future investor.

Podcast

Expert guests share their views about investing, the market, the economy and all their opinions about current events and how they may affect your portfolio. Discover our Invest with CARL podcast. Dive deeper with detailed discussions, and important new for CARL members.

Webinars

Listen and learn from handpicked speakers in our webinars. Learn what's important in the world of alternative investment products and get to know everything an investor or manager might need to know

Investment Basics

Start from scratch or refresh your knowledge with our extensive archive of investment articles. Brush up on essentials like mutual funds, securities and equity to make sound investment decisions.

FAQ

You are not the first person to ask any given question about the alternative investments. Use our FAQ to find the most commonly-asked questions and get into the game today.